Markets

Saif

@oilking

Contract:

247.5 Strike Put for

Apr 11

Thesis

Go back

Degenerate

@wsb

I believe AppLovin is on the brink of being deplatformed, and if this happens, the stock could rapidly approach $0. With the current market sentiment ...

Read

More

Thesis

I believe AppLovin is on the brink of being deplatformed, and if this happens, the stock could rapidly approach $0. With the current market sentiment and reports from short sellers, it feels like a smart move to short APP now before the potential collapse kicks in.

Go back

Degenerate

@wsb

Contract:

360 Strike Put for

Mar 28

Given the recent report raising potential fraud concerns, I believe there's a solid case for shorting AppLovin. Even if they appear to be performing w...

Read

More

Thesis

Given the recent report raising potential fraud concerns, I believe there's a solid case for shorting AppLovin. Even if they appear to be performing well, the market's reaction could lead to a downturn, and I've been making profits from this stock's decline since it peaked.

Go back

Contract:

270 Strike Call for

Mar 14

S&p inclusion lotto

Thesis

S&p inclusion lotto

Go back

Hammad

@hammadha...

APP might pop 20$ from here. S&P inclusion

Trims & Adds

[] Made $223.9K in profit

[-] 124d ago

All out @

387.40

[+] 272d ago

Added 1.0K shares @

253.96

[+] 276d ago

Added 500.00 shares @

266.34

[+] 283d ago

Initial 500.00 shares @

327.60

Thesis

APP might pop 20$ from here. S&P inclusion

Go back

itrader001

@itrader0...

Contract:

300 Strike Call for

Jan 16, 26

Thesis

Go back

itrader001

@itrader0...

Contract:

480 Strike Call for

Feb 28

Trims & Adds

[] Currently down $17.9K

[+] 291d ago

Added 10.00 contracts @

6.39

[+] 291d ago

Initial 10.00 contracts @

11.54

Thesis

Go back

itrader001

@itrader0...

Contract:

490 Strike Put for

Feb 21

Thesis

Go back

Thesis

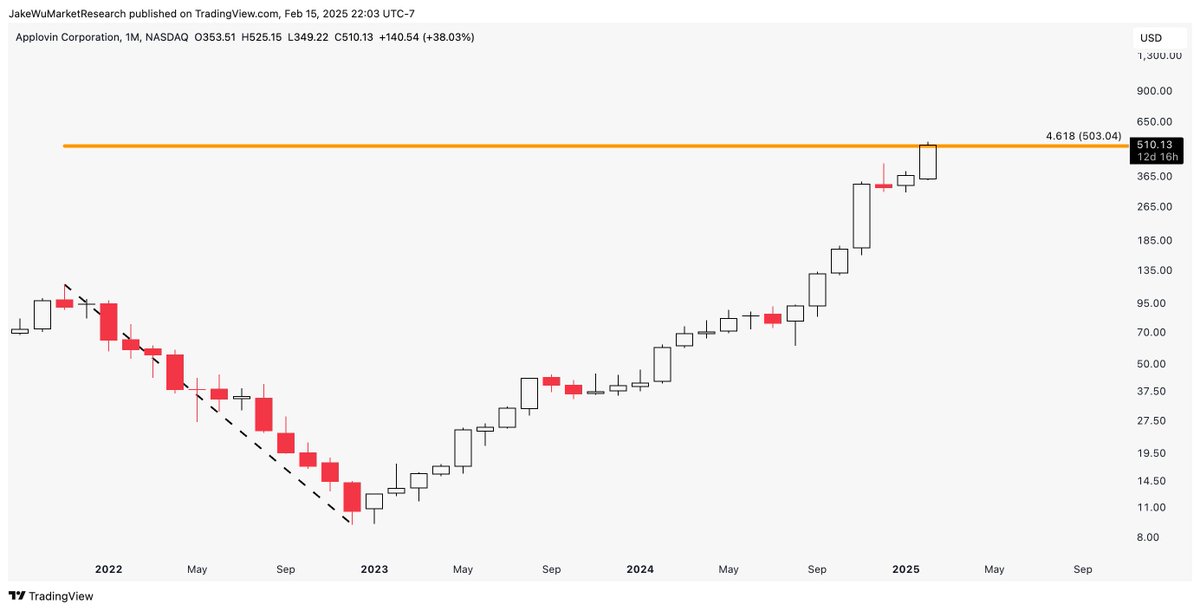

Closed almost EXACTLY at the 5.618 Fib extension this week as shown on this monthly chart.

Go back

Scalp

@scalpgan...

I just bought shares of AppLovin after their impressive Q4 results and a significant jump in stock price. Their decision to offload their mobile gamin...

Read

More

Thesis

I just bought shares of AppLovin after their impressive Q4 results and a significant jump in stock price. Their decision to offload their mobile gaming business to focus on AI-powered ads looks like a solid strategy, and I believe they have a bright future ahead.

Go back

Degenerate

@wsb

Just saw that AppLovin is flying high after blowing past earnings expectations and has a solid outlook. With its AI-driven growth and improving margin...

Read

More

Thesis

Just saw that AppLovin is flying high after blowing past earnings expectations and has a solid outlook. With its AI-driven growth and improving margins, I think there's still upside potential in the coming weeks. Definitely looking to ride this wave for a bit longer.

Go back

Scalp

@scalpgan...

Contract:

455 Strike Call for

Feb 14

I've just sold a strangle on AppLovin due to its high IV. Though I'm facing a loss currently, I still see potential in the volatility and might consid...

Read

More

Thesis

I've just sold a strangle on AppLovin due to its high IV. Though I'm facing a loss currently, I still see potential in the volatility and might consider rolling over the position if market conditions align. It's an interesting play that could turn around.

Go back

Remzztrades

@remzztra...

Contract:

400 Strike Call for

Jan 31

Thesis

Go back

smartertrader

@smartert...

App is breaking out of a 7-week range, targeting 400.

Thesis

App is breaking out of a 7-week range, targeting 400.

Go back

Degenerate

@wsb

I'm considering initiating a short position on AppLovin because I'm skeptical about their valuation compared to major gaming companies. There seems to...

Read

More

Thesis

I'm considering initiating a short position on AppLovin because I'm skeptical about their valuation compared to major gaming companies. There seems to be a disconnect between their growth numbers and the fundamentals, and I think it's a matter of time before reality sets in.

Go back

Degenerate

@wsb

I believe AppLovin is headed for a downturn after noting the unsustainable growth and reliance on questionable advertising practices. The stock's mete...

Read

More

Thesis

I believe AppLovin is headed for a downturn after noting the unsustainable growth and reliance on questionable advertising practices. The stock's meteoric rise seems likely to face challenges ahead, making it a prime candidate to short in the near term.

Go back

Long

@long_gam...

I believe APP is a strong contender for long-term growth, especially since they recently excelled in earnings and leverage AI for business expansion. ...

Read

More

Thesis

I believe APP is a strong contender for long-term growth, especially since they recently excelled in earnings and leverage AI for business expansion. The stock is down significantly from its highs, making it an attractive entry point ahead of the upcoming earnings report in February.

Go back

AtomicG

@atomicg

Contract:

350 Strike Put for

Dec 13, 24

Thesis

Go back

Posted

1.0y ago

-99.86%

Swung

•

Bullish

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Thesis

Go back

coco

@coco.cub...

Contract:

390 Strike Call for

Dec 06, 24

Thesis

Go back

coco

@coco.cub...

Contract:

360 Strike Call for

Dec 06, 24

Thesis

Go back

Degenerate

@wsb

Contract:

330 Strike Call for

Nov 29, 24

I'm holding this position for the upcoming S&P inclusion on December 6th, and I believe this is a strong opportunity for a bullish play. Even with a s...

Read

More

Thesis

I'm holding this position for the upcoming S&P inclusion on December 6th, and I believe this is a strong opportunity for a bullish play. Even with a significant rise this month, the long-term potential looks promising with analysts projecting prices in the $400s.

Go back

Degenerate

@wsb

Contract:

330 Strike Call for

Nov 29, 24

With APP's S&P inclusion on December 6th, I'm feeling bullish on the stock. I'm looking at buying calls at a $330 strike because the option flow sugge...

Read

More

Thesis

With APP's S&P inclusion on December 6th, I'm feeling bullish on the stock. I'm looking at buying calls at a $330 strike because the option flow suggests significant upward momentum. I believe the stock could push closer to $450, making this a solid play.

Go back

Degenerate

@wsb

With AppLovin's strong YTD performance of over 764% and a revenue surge of 38.64% year-over-year for Q3 2024, I'm feeling confident about holding my s...

Read

More

Thesis

With AppLovin's strong YTD performance of over 764% and a revenue surge of 38.64% year-over-year for Q3 2024, I'm feeling confident about holding my shares. Analysts are targeting a rise to $400, making this a solid play for the near future.

Go back

Thesis

Nearing the 3.618 extension of the November '21 to December '22 measured move at $396.

Go back

Remzztrades

@remzztra...

Contract:

400 Strike Call for

Nov 29, 24

Thesis

Go back