Markets

Degenerate

@wsb

With ARM securing a $250 million semiconductor licensing deal with Malaysia for the next decade, I see significant growth potential in the company's b...

Read

More

Thesis

With ARM securing a $250 million semiconductor licensing deal with Malaysia for the next decade, I see significant growth potential in the company's business model. This partnership could drive up the stock price as the company expands its market presence in semiconductor production.

Go back

Gamma

@gamma

Contract:

160.0 Strike Call for

Jun 20

I recently invested $2.76M in ARM calls with a strike of 160.0 and expiration on 2025-06-20. Given Arm Holdings' strong financials, robust growth in t...

Read

More

Thesis

I recently invested $2.76M in ARM calls with a strike of 160.0 and expiration on 2025-06-20. Given Arm Holdings' strong financials, robust growth in the AI sector, and its plans to significantly enhance revenue through new chip designs, I believe the current dip presents a prime buying opportunity for long-term gains.

Go back

Thesis

Go back

Thesis

Go back

Posted

298d ago

29.44%

Scalped

•

Bearish

fizzle

@tradetas...

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Thesis

Scalping pre-defined conditionals at the money for ARM.

Go back

viking-trades

@viking-t...

Contract:

167.50 Strike Call for

Jan 24

ARM calls for a day trade bounce.

Thesis

ARM calls for a day trade bounce.

Go back

Thesis

solid entry right before the spike!

Go back

Thesis

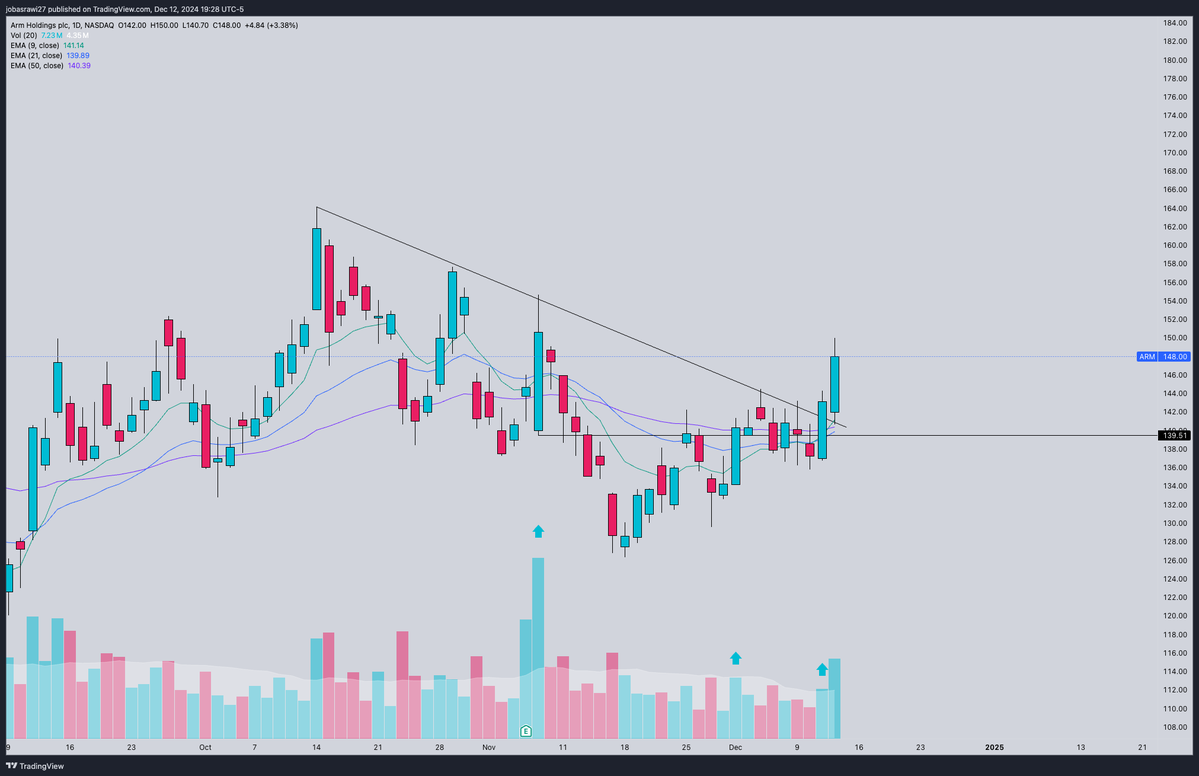

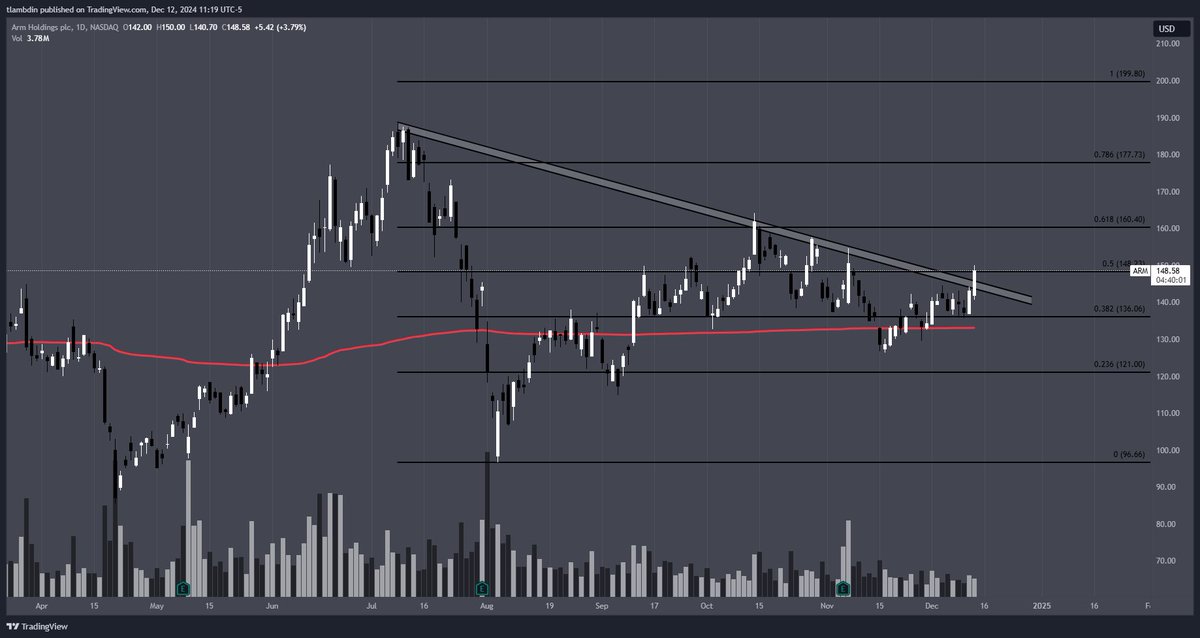

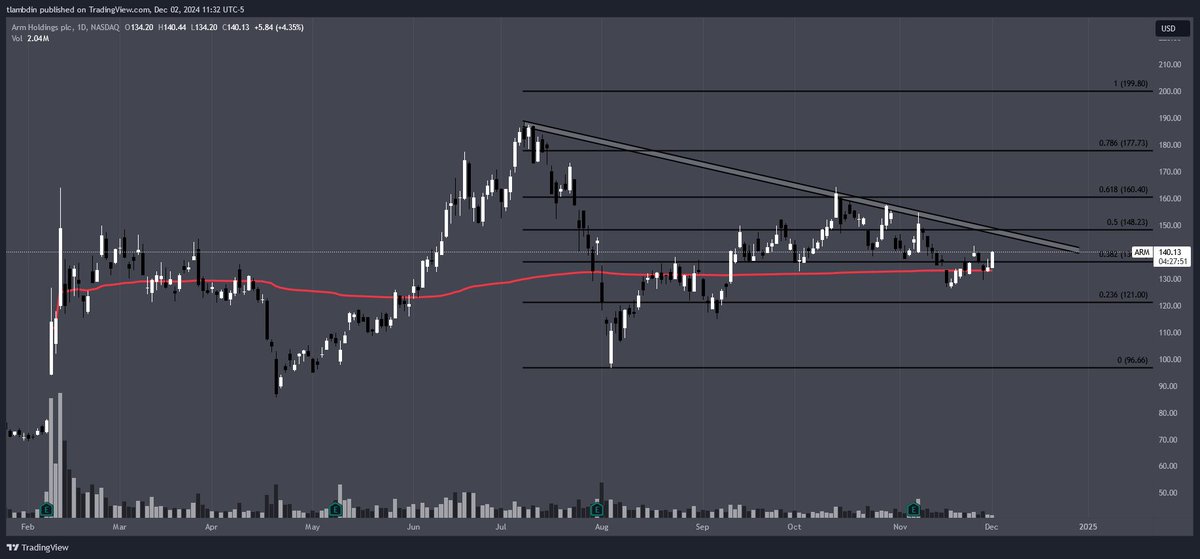

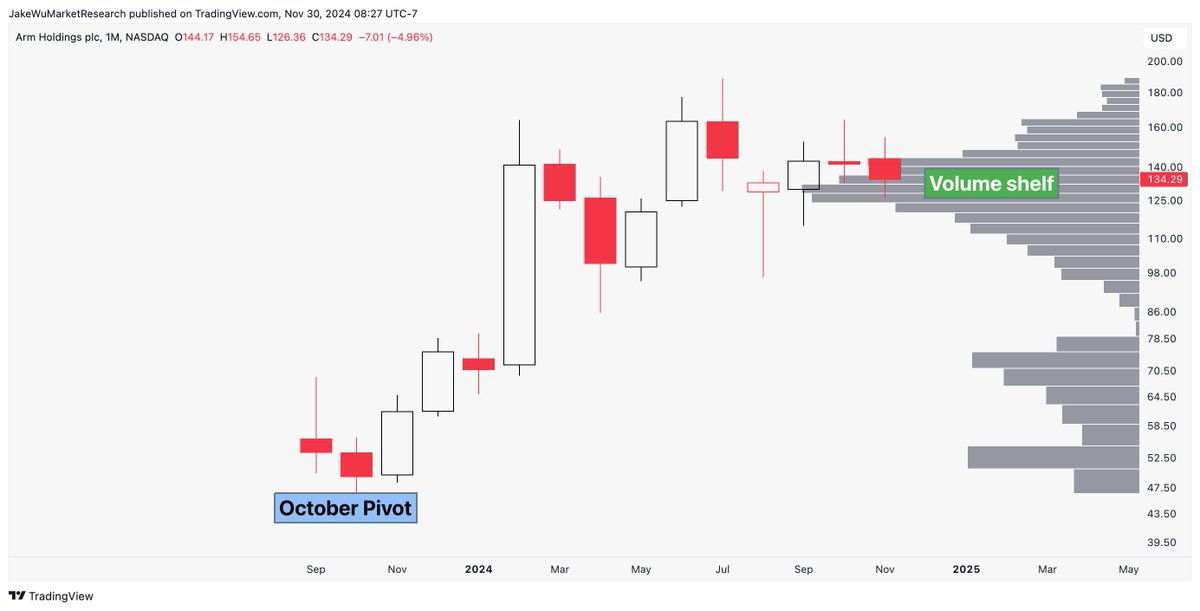

A beautiful volume shelf setup on the weekly candle chart.

Go back

Thesis

Still holding at the volume shelf. Crazy to see some of these names hold while $AMD is in free fall.

Go back

Degenerate

@wsb

Contract:

140 Strike Call for

Dec 20, 24

I'm really excited about the potential for ARM with the CEO's $100 billion investment in the US AI sector. This could drive significant growth and mar...

Read

More

Thesis

I'm really excited about the potential for ARM with the CEO's $100 billion investment in the US AI sector. This could drive significant growth and market interest, so I'm planning to buy some calls to capitalize on the upward momentum.

Go back

Posted

336d ago

-99.39%

Daytraded

•

Bullish

sniper

@sniper

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Thesis

Go back

Thesis

Big winner here for anyone that took this. Next targets: 160.

Go back

Remzztrades

@remzztra...

Contract:

185 Strike Call for

Jan 17

Thesis

Go back

Posted

340d ago

40.67%

Daytraded

•

Bullish

•

Exited

sniper

@sniper

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Made $354.60 in profit

[-] 340d ago

All out @

1.31

[-] 340d ago

Trimmed 3.00 contracts @

1.17

[-] 340d ago

Trimmed 3.00 contracts @

1.17

[+] 340d ago

Initial 10.00 contracts @

0.87

Trade is closed already

Thesis

Go back

Posted

341d ago

103%

Daytraded

•

Bullish

•

Exited

sniper

@sniper

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Made $1.1K in profit

[-] 341d ago

All out @

2.78

[-] 341d ago

Trimmed 8.00 contracts @

1.91

[+] 341d ago

Initial 10.00 contracts @

1.03

Trade is closed already

Thesis

Go back

Thesis

getting super tight and coiled here. strong day today. if semis find a local bottom here, this would be my TOP watch.

Go back

Posted

341d ago

26.34%

Daytraded

•

Bullish

•

Exited

sniper

@sniper

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Made $225.20 in profit

[-] 341d ago

All out @

1.42

[-] 341d ago

Trimmed 7.00 contracts @

0.94

[+] 341d ago

Initial 10.00 contracts @

0.85

Trade is closed already

Thesis

Go back

Posted

342d ago

14.43%

Daytraded

•

Bullish

•

Exited

sniper

@sniper

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

Go back

Posted

343d ago

71.78%

Daytraded

•

Bullish

•

Exited

sniper

@sniper

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

Go back

Scalp

@scalpgan...

Contract:

138 Strike Put for

Dec 13, 24

I’m eyeing ARM for a potential rejection at $140 with my stop set at $141. I think the way it’s moving, a push back down would make the $138 put a sol...

Read

More

Thesis

I’m eyeing ARM for a potential rejection at $140 with my stop set at $141. I think the way it’s moving, a push back down would make the $138 put a solid play.

Go back

Posted

344d ago

20.29%

Daytraded

•

Bullish

•

Exited

sniper

@sniper

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Made $591.00 in profit

[-] 344d ago

All out @

1.02

[-] 344d ago

Trimmed 5.00 contracts @

1.49

[-] 344d ago

Trimmed 5.00 contracts @

1.43

[+] 344d ago

Initial 30.00 contracts @

0.97

Trade is closed already

Thesis

Go back

Thesis

Go back

Degenerate

@wsb

I'm really bullish on ARM right now, especially with TD Cowen raising their price target to $165 due to strong licensing growth. The shift towards AI ...

Read

More

Thesis

I'm really bullish on ARM right now, especially with TD Cowen raising their price target to $165 due to strong licensing growth. The shift towards AI and edge computing is huge, and the new v9 architecture significantly boosts royalty rates. I see this stock running up soon.

Go back

Posted

1.0y ago

-93.95%

Swung

•

Bullish

•

Exited

Jawnknee

@jawnknee

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Lost $7.7K on the trade

[-] 351d ago

All out @

0.25

[+] 1.0y ago

Added 10.00 contracts @

3.65

[+] 1.0y ago

Initial 10.00 contracts @

4.58

Trade is closed already

Thesis

This will be a gift. 167.5 price target over 152. Must buy if it retests 145. Accumulate over the next week 12/20 or 1/17/24

Go back