Markets

Scalp

@scalpgan...

Contract:

54.5 Strike Call for

Jan 17

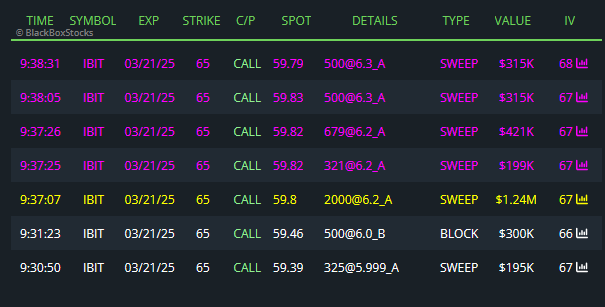

I just bought a significant number of calls for IBIT, anticipating a gap up after the weekend. The previous trends show strong potential around major ...

Read

More

Thesis

I just bought a significant number of calls for IBIT, anticipating a gap up after the weekend. The previous trends show strong potential around major announcements, and I believe we could see a similar spike soon based on historical patterns.

Go back

Posted

307d ago

68.13%

Swung

•

Bullish

•

Exited

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Made $2.9K in profit

[-] 305d ago

All out @

2.37

[+] 306d ago

Added 20.00 contracts @

1.31

[+] 307d ago

Initial 10.00 contracts @

1.62

Trade is closed already

Thesis

Go back

Posted

315d ago

21.03%

Swung

•

Bullish

•

Exited

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Made $3.8K in profit

[-] 308d ago

All out @

1.56

[+] 308d ago

Added 100.00 contracts @

1.07

[+] 314d ago

Added 30.00 contracts @

1.71

[+] 315d ago

Initial 10.00 contracts @

2.22

Trade is closed already

Thesis

Go back

sanemi

@sanemi

Contract:

58 Strike Call for

Jan 17

this is a swing play

Thesis

this is a swing play

Go back

Degenerate

@wsb

I'm bullish on IBIT because the current call skew indicates the market expects it to rise significantly. With Bitcoin's price expectation above 99.5k ...

Read

More

Thesis

I'm bullish on IBIT because the current call skew indicates the market expects it to rise significantly. With Bitcoin's price expectation above 99.5k by March 21st, I'm looking to profit substantially from this position, especially since I've locked in my downside risk.

Go back

Posted

340d ago

251%

Scalped

•

Bullish

•

Exited

JD_Rock

@jd_rock

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

Long high rr lotto scalp for test of hod... can use more time VWAP is 57.32 buying 56.41 for Dec 20th if these fail.

Go back

Stonks

@stocks

I'm considering taking a position in IBIT because it offers direct exposure to Bitcoin. It could be a solid long-term hold in my portfolio as a way to...

Read

More

Thesis

I'm considering taking a position in IBIT because it offers direct exposure to Bitcoin. It could be a solid long-term hold in my portfolio as a way to benefit from any future gains in Bitcoin without the operational risks of a business like Coinbase.

Go back

Krivo

@Wildman

Contract:

55 Strike Call for

Jan 17

Thesis

Go back

Gamma

@gamma

Contract:

55.0 Strike Call for

Jan 17

I invested $10.7M in IBIT calls with a strike of $55.0 expiring on 2025-01-17, driven by billionaire hedge-fund manager Paul Tudor Jones' aggressive b...

Read

More

Thesis

I invested $10.7M in IBIT calls with a strike of $55.0 expiring on 2025-01-17, driven by billionaire hedge-fund manager Paul Tudor Jones' aggressive buying in Bitcoin as a hedge against inflation and the overall bullish sentiment surrounding the iShares Bitcoin Trust ETF amid soaring demand from institutional investors.

Go back

JD_Rock

@jd_rock

Contract:

60 Strike Call for

Jan 17

Long Jan 60c for ibit for swingg on bitcoin bulls- let's see if this flow takes us itm

Thesis

Long Jan 60c for ibit for swingg on bitcoin bulls- let's see if this flow takes us itm

Go back

coco

@coco.cub...

Contract:

63 Strike Call for

Dec 20, 24

Thesis

Go back

Tudor

@tudor-in...

Trims & Adds

[] Currently up $84.3M

[+] 1.1y ago

Added 3.6M shares @

36.13

[+] 1.4y ago

Initial 869.6K shares @

36.00

Thesis

Go back

Thesis

Go back

Thesis

Go back

Citadel

@citadel-...

Trims & Adds

[] Currently down $1.3M

[-] 1.1y ago

Trimmed 43.1K shares @

36.13

[-] 1.4y ago

Trimmed 377.5K shares @

36.00

[+] 1.6y ago

Initial 440.7K shares @

39.75

Thesis

Go back