Markets

Degenerate

@wsb

Contract:

40 Strike Call for

Dec 18, 26

I just bought more Dec 18 2026 calls at a 40 strike. With the cost reductions and the potential for a turnaround under new management, it feels like a...

Read

More

Thesis

I just bought more Dec 18 2026 calls at a 40 strike. With the cost reductions and the potential for a turnaround under new management, it feels like a great opportunity to leverage the upside potential in Intel's stock.

Go back

Stonks

@stocks

Intel's outlook looks gloomy with revenue guidance below expectations and increasing risks from tariffs suggesting a bearish trend. The broader econom...

Read

More

Thesis

Intel's outlook looks gloomy with revenue guidance below expectations and increasing risks from tariffs suggesting a bearish trend. The broader economic concerns combined with their weak market position relative to competitors like AMD make me think it’s time to short this stock.

Go back

The

@themarke...

I just bought INTC shares ahead of its earnings report. With a solid gain of nearly 4% today and the strength in the semiconductor sector, I believe t...

Read

More

Thesis

I just bought INTC shares ahead of its earnings report. With a solid gain of nearly 4% today and the strength in the semiconductor sector, I believe there's potential for even more upside as investors react positively to the earnings.

Go back

Stonks

@stocks

Contract:

20.5 Strike Call for

Apr 25

I just bought 2000 shares of Intel at $19.5 and sold calls for the $20.5 strike. I believe the restructuring and significant layoffs will be bullish i...

Read

More

Thesis

I just bought 2000 shares of Intel at $19.5 and sold calls for the $20.5 strike. I believe the restructuring and significant layoffs will be bullish in the long term as they cut inefficiencies, making it a solid play for upcoming weeks.

Go back

Degenerate

@wsb

Contract:

35 Strike Call for

Jun 18, 26

I'm feeling bullish on Intel with the new CEO Lip Bu Tan at the helm and plans to turn the company around. Even if there's some skepticism about marke...

Read

More

Thesis

I'm feeling bullish on Intel with the new CEO Lip Bu Tan at the helm and plans to turn the company around. Even if there's some skepticism about market trends, I believe the potential for growth in the near future is strong, and I'm going long with June 2026 $35 calls.

Go back

Stonks

@stocks

Given the recent developments regarding rare earth metals and Intel's position in the semiconductor supply chain, I believe there’s a positive outlook...

Read

More

Thesis

Given the recent developments regarding rare earth metals and Intel's position in the semiconductor supply chain, I believe there’s a positive outlook for INTC. The company seems well-positioned to handle supply chain issues, especially with their recent TSMC joint venture and a focus on US manufacturing.

Go back

Scalp

@scalpgan...

With significant insider buying recently and an upcoming earnings announcement within the next two weeks, I see INTC having a potential upside. The el...

Read

More

Thesis

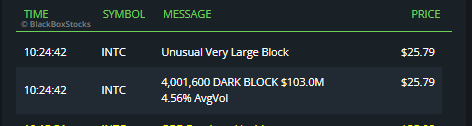

With significant insider buying recently and an upcoming earnings announcement within the next two weeks, I see INTC having a potential upside. The elevated trading volume also indicates strong interest, making this a reliable pick for a day trade.

Go back

Degenerate

@wsb

Contract:

25 Strike Call for

Apr 04

I just loaded up on INTC calls, banking on a short-term spike after the recent jump to $26. While the sentiment is mixed, there's potential for recove...

Read

More

Thesis

I just loaded up on INTC calls, banking on a short-term spike after the recent jump to $26. While the sentiment is mixed, there's potential for recovery with a new CEO possibly turning things around, making this a speculative but interesting play.

Go back

Stonks

@stocks

I believe INTC is headed below $20 as there's significant concern over its new CEO and future capex decisions. With the competitive landscape tougheni...

Read

More

Thesis

I believe INTC is headed below $20 as there's significant concern over its new CEO and future capex decisions. With the competitive landscape toughening, it feels like this company is losing its footing, and I'm not convinced it's worth holding onto right now.

Go back

The

@themarke...

Contract:

30 Strike Call for

Dec 18, 26

I really believe Intel is gearing up for a big rebound, especially with the new plants planned. Despite the delays, I see a potential for the stock to...

Read

More

Thesis

I really believe Intel is gearing up for a big rebound, especially with the new plants planned. Despite the delays, I see a potential for the stock to double or triple in the next couple of years, and that's why I just bought some call options at a great strike.

Go back

The

@themarke...

I believe Intel is in a rough financial situation and might be headed toward a significant drop, especially considering the discussions about liquidat...

Read

More

Thesis

I believe Intel is in a rough financial situation and might be headed toward a significant drop, especially considering the discussions about liquidation of assets. The stock seems overly hyped right now, but I expect it’ll settle down, making it a good opportunity for a short position.

Go back

Scalp

@scalpgan...

Contract:

21 Strike Call for

Mar 14

I've been making calls on Intel as a hedge, and it really paid off today. Given the stock's recent movement, I'm feeling bullish on this play and see ...

Read

More

Thesis

I've been making calls on Intel as a hedge, and it really paid off today. Given the stock's recent movement, I'm feeling bullish on this play and see potential for further gains in the coming days.

Go back

Degenerate

@wsb

With the recent appointment of Lip-Bu Tan as CEO, I'm feeling optimistic about Intel's turnaround potential. The jump in share price reflects investor...

Read

More

Thesis

With the recent appointment of Lip-Bu Tan as CEO, I'm feeling optimistic about Intel's turnaround potential. The jump in share price reflects investor confidence, and I believe that as the company navigates its challenges, this stock could see further gains.

Go back

Degenerate

@wsb

Contract:

20.5 Strike Call for

Mar 14

I think now is a good time to jump on some INTC calls with the new CEO taking the helm. The overall sentiment around his appointment indicates a possi...

Read

More

Thesis

I think now is a good time to jump on some INTC calls with the new CEO taking the helm. The overall sentiment around his appointment indicates a possible turnaround for the company, and I expect some positive movements in the stock soon.

Go back

Stonks

@stocks

The potential repeal of the Chips Act is bad news for Intel, as it stands to lose out on crucial support for its manufacturing projects in the U.S. Wi...

Read

More

Thesis

The potential repeal of the Chips Act is bad news for Intel, as it stands to lose out on crucial support for its manufacturing projects in the U.S. With the uncertainty in government funding, I foresee a downturn for INTC as the semiconductor sector faces increased pressure and dependency on international production.

Go back

Degenerate

@wsb

I've been shorting Intel since those comments at the Trump and TSM meeting, and I see a lot of downside potential. With the market's upward trend, I b...

Read

More

Thesis

I've been shorting Intel since those comments at the Trump and TSM meeting, and I see a lot of downside potential. With the market's upward trend, I believe Intel is still lagging and can be a strong short candidate right now.

Go back

Degenerate

@wsb

I just invested $20k in Intel because I think it's really undervalued right now. Despite what others might say, I see potential for future growth as t...

Read

More

Thesis

I just invested $20k in Intel because I think it's really undervalued right now. Despite what others might say, I see potential for future growth as the market recovers. I believe this could pay off in the long term, even if it's not a popular choice right now.

Go back

Degenerate

@wsb

Contract:

24.5 Strike Call for

Mar 07

With Intel testing chips on a new manufacturing process and strong sentiment around its price, I see great potential for a swing trade on calls. The m...

Read

More

Thesis

With Intel testing chips on a new manufacturing process and strong sentiment around its price, I see great potential for a swing trade on calls. The momentum from this news could drive INTC's price higher in the near future.

Go back

Degenerate

@wsb

Contract:

25 Strike Put for

Feb 28

Given the uncertainty surrounding TSMC's investment rumors and potential implications for Intel, I’m leaning towards buying puts on INTC. Market senti...

Read

More

Thesis

Given the uncertainty surrounding TSMC's investment rumors and potential implications for Intel, I’m leaning towards buying puts on INTC. Market sentiment seems bearish, and I believe it could face downward pressure based on this news.

Go back

Scalp

@scalpgan...

I'm really optimistic about Intel right now, especially with their new AI cards making gains against NVIDIA in the datacenter space. The uptrend is pr...

Read

More

Thesis

I'm really optimistic about Intel right now, especially with their new AI cards making gains against NVIDIA in the datacenter space. The uptrend is pretty clear, and I think it's worth taking a position for the next few days to capitalize on this momentum.

Go back

Long

@long_gam...

I'm looking to add a long position in INTC because I see technical improvements and believe once it breaks above its key moving averages, it could att...

Read

More

Thesis

I'm looking to add a long position in INTC because I see technical improvements and believe once it breaks above its key moving averages, it could attract significant investment. With the recent focus on domestic chip production, I think there's potential for solid long-term growth.

Go back

Stonks

@stocks

With the uncertainty surrounding Intel's strategic moves and potential deals being considered by rivals, I'm convinced that Intel's stock may continue...

Read

More

Thesis

With the uncertainty surrounding Intel's strategic moves and potential deals being considered by rivals, I'm convinced that Intel's stock may continue its downward trend. The lack of confidence in its leadership and looming government scrutiny on foreign ownership significantly impacts its future outlook.

Go back

Degenerate

@wsb

With the potential renegotiation of the CHIPS Act possibly favoring Intel, I believe there might be a significant boost in its stock price. I'm feelin...

Read

More

Thesis

With the potential renegotiation of the CHIPS Act possibly favoring Intel, I believe there might be a significant boost in its stock price. I'm feeling bullish on Intel and looking to hold for a swing trade as market dynamics around chip manufacturing shift.

Go back

The

@themarke...

I believe Intel is on a solid path despite recent fluctuations. With expected growth from new products and positive US political sentiment, this pullb...

Read

More

Thesis

I believe Intel is on a solid path despite recent fluctuations. With expected growth from new products and positive US political sentiment, this pullback seems like a good opportunity to buy before it rises again. The long-term outlook remains strong.

Go back

Degenerate

@wsb

Contract:

23.5 Strike Call for

Feb 21

I strongly believe INTC is set for a significant uptick and could reach $30 in the next three months, especially with recent developments in the marke...

Read

More

Thesis

I strongly believe INTC is set for a significant uptick and could reach $30 in the next three months, especially with recent developments in the market. I'm loading up on calls, as I anticipate robust growth ahead despite some political headwinds.

Go back

The

@themarke...

Contract:

32 Strike Call for

Dec 19

I believe Intel has great long-term potential, especially with the government's push for domestic chip production. I'm looking at buying call options ...

Read

More

Thesis

I believe Intel has great long-term potential, especially with the government's push for domestic chip production. I'm looking at buying call options with a strike of $32, which I think gives us good upside potential in the coming months.

Go back

Thesis

Still room to move higher here up to $28-$29 which is the VWAP zone above.

Go back

The

@themarke...

I'm convinced that Intel's current pricing is a solid entry point. With upcoming production ramp-up around 2026 and a perceived book value of $35-40, ...

Read

More

Thesis

I'm convinced that Intel's current pricing is a solid entry point. With upcoming production ramp-up around 2026 and a perceived book value of $35-40, I see a substantial upside potential. I plan to hold and aim to sell around $29 when it hits that major resistance.

Go back