Markets

Mehmud

@mehmudiq...

Contract:

395 Strike Call for

Aug 29

Thesis

Go back

Hammad

@hammadha...

Contract:

400 Strike Put for

Aug 15

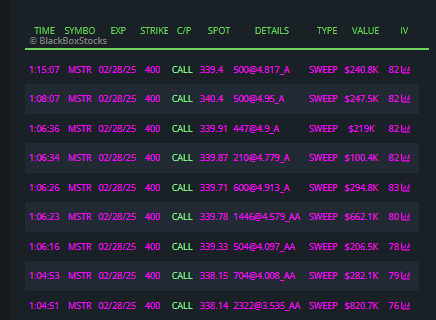

This is options play. Options premium is more than 500K.

Thesis

This is options play. Options premium is more than 500K.

Go back

Saif

@oilking

Contract:

392.5 Strike Call for

Jul 03

Thesis

Go back

Saif

@oilking

Contract:

387.5 Strike Put for

Jun 27

Thesis

Go back

Saif

@oilking

Contract:

375 Strike Call for

Jun 27

Thesis

Go back

Posted

165d ago

36.85%

Swung

•

Bullish

•

Exited

JD_Rock

@jd_rock

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

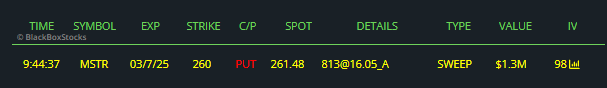

long MSTR swing trade idea. Can follow the Whales flow using June 27, but as a rule, like to add time for big trades. Expecting itm. June 27 contract entry was 2.80.

Go back

Degenerate

@wsb

Contract:

390 Strike Call for

May 02

I believe that MSTR could see a positive earnings surprise thanks to FASB developments, making me bullish on their swing potential. With discussions a...

Read

More

Thesis

I believe that MSTR could see a positive earnings surprise thanks to FASB developments, making me bullish on their swing potential. With discussions aiming for a return to strong pricing, I'm ready to back this earnings play.

Go back

Scalp

@scalpgan...

I just sold MSTR at 329, but I see it's now at 350. This stock has shown consistent volatility, which I thrive on. I've had a good run with it, and ev...

Read

More

Thesis

I just sold MSTR at 329, but I see it's now at 350. This stock has shown consistent volatility, which I thrive on. I've had a good run with it, and even if I missed a bump, I still believe it has room to grow in the upcoming weeks.

Go back

Scalp

@scalpgan...

Contract:

250 Strike Call for

Apr 11

I believe MSTR could rebound soon based on its recent price action and my analysis. I’m looking to play calls when the stock shows signs of bullish mo...

Read

More

Thesis

I believe MSTR could rebound soon based on its recent price action and my analysis. I’m looking to play calls when the stock shows signs of bullish momentum. It's a high-risk play, but I feel like the stock has potential for a short-term turnaround.

Go back

Scalp

@scalpgan...

Contract:

310 Strike Put for

Apr 11

I’m looking at MSTR puts because despite the recent uptick in the stock price, many traders believe it’s going to fall on Monday. The increased implie...

Read

More

Thesis

I’m looking at MSTR puts because despite the recent uptick in the stock price, many traders believe it’s going to fall on Monday. The increased implied volatility suggests that there's a mix of uncertainty and bearish sentiment right now, setting the stage for potential profit.

Go back

Degenerate

@wsb

Contract:

310 Strike Put for

Apr 11

I see the chatter around MSTR puts and it seems like a careful play to take. Even though there’s some risk talk, the momentum we've been seeing makes ...

Read

More

Thesis

I see the chatter around MSTR puts and it seems like a careful play to take. Even though there’s some risk talk, the momentum we've been seeing makes me think it’s worth looking into for a potential dip down.

Go back

Ron

@tradewit...

Contract:

305 Strike Put for

Mar 28

Thesis

Go back

Degenerate

@wsb

It seems like MSTR is not in a strong position, and I expect it to drop further. The stock has been under pressure and is likely to be affected negati...

Read

More

Thesis

It seems like MSTR is not in a strong position, and I expect it to drop further. The stock has been under pressure and is likely to be affected negatively by market movements, making it a candidate for a short play.

Go back

Degenerate

@wsb

Contract:

302.5 Strike Put for

Mar 14

I just bought a few thousand in puts on MSTR, as I believe it's ripe for a big downturn. With the CEO's recent actions and the lack of real income, it...

Read

More

Thesis

I just bought a few thousand in puts on MSTR, as I believe it's ripe for a big downturn. With the CEO's recent actions and the lack of real income, it's clear to me that they might not be able to sustain their operations without defaulting on dividends soon.

Go back

Degenerate

@wsb

I just made a great trade shorting MSTR. It dropped significantly from $500 to $230, and with the current overvaluation, I believe there's still a str...

Read

More

Thesis

I just made a great trade shorting MSTR. It dropped significantly from $500 to $230, and with the current overvaluation, I believe there's still a strong potential for it to decrease further, making it a solid swing trade opportunity.

Go back

The

@themarke...

I'm planning to sell my MSTR shares as I want to minimize my exposure to volatility. With the market's unpredictable nature and my focus on long-term ...

Read

More

Thesis

I'm planning to sell my MSTR shares as I want to minimize my exposure to volatility. With the market's unpredictable nature and my focus on long-term stability, it feels like the right time to cash out and prepare to buy more stable stocks like VOO and NVDA when they dip.

Go back

Stonks

@stocks

I'm leaning short on MSTR due to their new ATM program that involves selling a significant amount of preferred stock. With the current bearish sentime...

Read

More

Thesis

I'm leaning short on MSTR due to their new ATM program that involves selling a significant amount of preferred stock. With the current bearish sentiment in the crypto market, it seems like MSTR might struggle to meet its dividend obligations, making it a risky play right now.

Go back

Stonks

@stocks

Given the alarming situation around MicroStrategy's reliance on preferred stock and the potential for Bitcoin's decline, I think it's a good opportuni...

Read

More

Thesis

Given the alarming situation around MicroStrategy's reliance on preferred stock and the potential for Bitcoin's decline, I think it's a good opportunity to short MSTR. The risks involved with their financial strategies could lead to a serious downturn in the stock price in the near future.

Go back

Scalp

@scalpgan...

Contract:

315 Strike Call for

Mar 07

I'm feeling really bullish on MSTR and was just about to dive into MSTR calls with $3k. I have a strong hunch that this stock is gearing up for a sign...

Read

More

Thesis

I'm feeling really bullish on MSTR and was just about to dive into MSTR calls with $3k. I have a strong hunch that this stock is gearing up for a significant upward move, especially since everything I add to my watchlist tends to blow up.

Go back

Degenerate

@wsb

Contract:

320 Strike Call for

Mar 07

I just sold my MSTR calls and got my initial investment back along with some profit, which makes me optimistic about a potential upward movement in th...

Read

More

Thesis

I just sold my MSTR calls and got my initial investment back along with some profit, which makes me optimistic about a potential upward movement in the stock. With Trump's statements about leading in crypto, I believe there's a chance MSTR could see a resurgence soon.

Go back

Hammad

@hammadha...

Dip buying here. Will add periodically.

Thesis

Dip buying here. Will add periodically.

Go back

Long

@long_gam...

I'm shorting MSTR because their strategy is flawed. They have leveraged their position in Bitcoin without demonstrating actual returns, and as the pri...

Read

More

Thesis

I'm shorting MSTR because their strategy is flawed. They have leveraged their position in Bitcoin without demonstrating actual returns, and as the price of BTC fluctuates, this play seems unsustainable. If you can get out now, it's a good chance to profit as it likely falls further.

Go back

Thesis

Go back

Remzztrades

@remzztra...

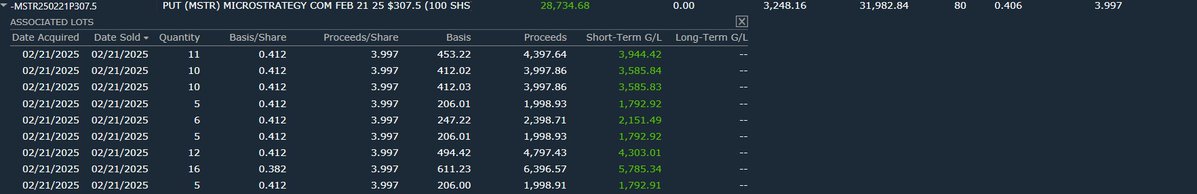

Contract:

305 Strike Put for

Feb 21

it can go to 300

Thesis

it can go to 300

Go back

Thesis

Go back

Thesis

We have a TIGHT triple inside BAR forming on the MONTHLY this is Extremely Rare and Ready for a MASSIVE BREAKOUT.

Go back