Markets

Tendies

@tendies

Contract:

6 Strike Call for

May 16

With a significant surge in call options activity and strong bullish sentiment, I believe NXE is poised for an upswing given the positive forecast fro...

Read

More

Thesis

With a significant surge in call options activity and strong bullish sentiment, I believe NXE is poised for an upswing given the positive forecast from analysts and the company's strong cash position. The favorable market dynamics signal a solid opportunity to buy calls on this stock.

Go back

Tendies

@tendies

I just see NexGen Energy as a huge opportunity with a strong upside potential of nearly 91%, especially with their Arrow project on the verge of becom...

Read

More

Thesis

I just see NexGen Energy as a huge opportunity with a strong upside potential of nearly 91%, especially with their Arrow project on the verge of becoming a significant uranium source. This combined with their long-term outlook in the uranium market makes it a great candidate for a swing trade right now.

Go back

Tendies

@tendies

I just bought shares in NexGen Energy after their recent drilling at the Rook I site found rich uranium concentrations. This kind of exceptional geolo...

Read

More

Thesis

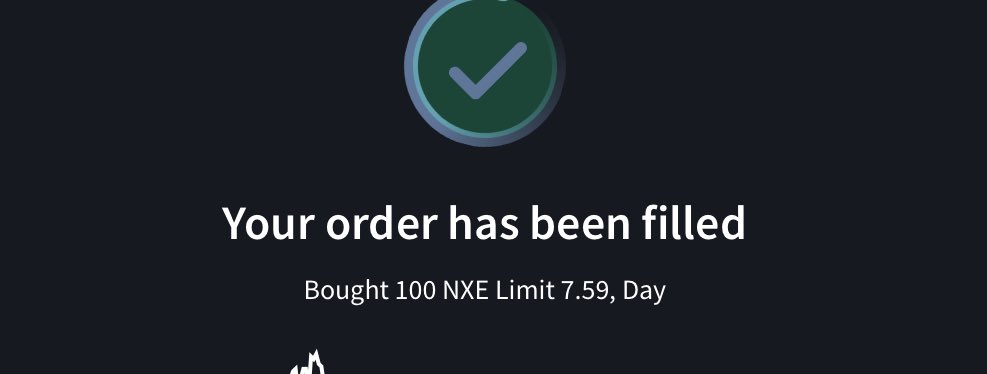

I just bought shares in NexGen Energy after their recent drilling at the Rook I site found rich uranium concentrations. This kind of exceptional geological discovery could have a significant impact on the company's value moving forward, especially with their 2025 program showing strong potential.

Go back

Tendies

@tendies

I recently noticed that NexGen Energy is progressing with a major exploration drill program aimed at expanding its resource base. With an analyst upsi...

Read

More

Thesis

I recently noticed that NexGen Energy is progressing with a major exploration drill program aimed at expanding its resource base. With an analyst upside potential of over 105%, I'm optimistic about NXE's future growth in the uranium sector, especially as it continues to develop its flagship project.

Go back

Tendies

@tendies

I'm excited about NexGen Energy as they recently received a 'Buy' rating from Stifel, with a price target of C$16. With ongoing positive developments ...

Read

More

Thesis

I'm excited about NexGen Energy as they recently received a 'Buy' rating from Stifel, with a price target of C$16. With ongoing positive developments in their Rook 1 project and potential M&A interest, I believe there's good momentum to capitalize on in the coming weeks.

Go back

Tendies

@tendies

With NexGen's CEO stating that they're close to securing deals to sell uranium to US utilities, I believe the stock has strong upward potential. The d...

Read

More

Thesis

With NexGen's CEO stating that they're close to securing deals to sell uranium to US utilities, I believe the stock has strong upward potential. The demand for nuclear fuel seems unwavering despite trade tensions, positioning this company well in a growing market.

Go back

Tendies

@tendies

I'm really bullish on NexGen Energy right now. With the potential for uranium prices to surge due to supply constraints and increasing demand from nuc...

Read

More

Thesis

I'm really bullish on NexGen Energy right now. With the potential for uranium prices to surge due to supply constraints and increasing demand from nuclear energy, NXE is uniquely positioned with their Rook I project. I expect a price increase of 30-40% in the next year or so if these trends continue.

Go back

Tendies

@tendies

I'm looking at NexGen Energy (NXE) with a solid upside potential of 38.9% based on analyst price targets. Given the positive earnings estimate revisio...

Read

More

Thesis

I'm looking at NexGen Energy (NXE) with a solid upside potential of 38.9% based on analyst price targets. Given the positive earnings estimate revisions and strong agreement among analysts, I think this stock is set for growth in the coming weeks.

Go back

Thesis

Go back

Tendies

@tendies

I'm eyeing NexGen Energy because their flagship Arrow project has some seriously high-grade uranium reserves. With a solid cash position to drive deve...

Read

More

Thesis

I'm eyeing NexGen Energy because their flagship Arrow project has some seriously high-grade uranium reserves. With a solid cash position to drive development, this stock seems primed to take advantage of the rising energy demands tied to AI and geopolitical tensions.

Go back

Tendies

@tendies

Contract:

8 Strike Call for

Nov 15, 24

I'm really bullish on NXE heading into Q4, especially with the pending mine approval. If it goes through, I expect a significant rally in the stock pr...

Read

More

Thesis

I'm really bullish on NXE heading into Q4, especially with the pending mine approval. If it goes through, I expect a significant rally in the stock price due to the massive potential cash flow from uranium sales even with a modest price surge.

Go back

Tendies

@tendies

I believe Nexgen Energy is positioned to become a major player in the uranium sector with its Rook I Project. With the growing demand for uranium, thi...

Read

More

Thesis

I believe Nexgen Energy is positioned to become a major player in the uranium sector with its Rook I Project. With the growing demand for uranium, this project is likely to fill supply gaps and could be a substantial growth opportunity, making it a solid buy for the swing trade perspective.

Go back

Degenerate

@wsb

Contract:

8 Strike Call for

Nov 15, 24

I see real potential in NexGen Energy, especially with uranium's role in the clean energy push. With significant free cash flow projected and a possib...

Read

More

Thesis

I see real potential in NexGen Energy, especially with uranium's role in the clean energy push. With significant free cash flow projected and a possible M&A in the works, I'm looking to play around with calls on this stock as it might see some bullish moves soon.

Go back

The

@thenorth...

Breakout trade on chart and nuclear play

Thesis

Breakout trade on chart and nuclear play

Go back

Thesis

Go back

Tendies

@tendies

NexGen's updated economic estimates and environmental strategies for the Rook I Project indicate strong profitability and sustainability, with a payba...

Read

More

Thesis

NexGen's updated economic estimates and environmental strategies for the Rook I Project indicate strong profitability and sustainability, with a payback period of 12 months. The Project’s advanced engineering stage and imminent construction commencement position NXE for significant long-term growth as one of the largest low-cost uranium producers globally.

Go back

Thesis

Go back

Bridgewater

@bridgewa...

Trims & Adds

[] Currently down $6.9M

[-] 1.1y ago

Trimmed 367.4K shares @

6.53

[+] 1.4y ago

Added 1.6M shares @

6.91

[+] 1.6y ago

Initial 1.8M shares @

8.43

Thesis

Go back

Thesis

Go back