Markets

Stonks

@stocks

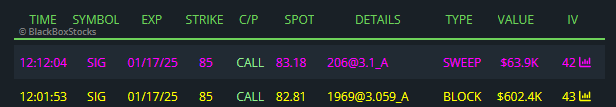

I'm long on SIG because it’s currently undervalued at 3.8x EBITDA and has multiple pathways to significant shareholder returns. With aggressive share ...

Read

More

Thesis

I'm long on SIG because it’s currently undervalued at 3.8x EBITDA and has multiple pathways to significant shareholder returns. With aggressive share repurchases and a strong focus on cost-saving initiatives, I believe this stock has the potential for a solid upside even amidst market uncertainties.

Go back

Bridgewater

@bridgewa...

Trims & Adds

[] Currently down $920.1K

[+] 1.1y ago

Added 8.6K shares @

103.14

[+] 1.3y ago

Initial 22.7K shares @

87.45

Thesis

Go back

Renaissance

@renaissa...

Trims & Adds

[] Currently down $912.0K

[-] 1.1y ago

Trimmed 160.8K shares @

103.14

[-] 1.3y ago

Trimmed 12.3K shares @

87.45

[+] 1.6y ago

Initial 214.0K shares @

98.71

Thesis

Go back

Scion

@scion-as...

Trims & Adds

[] Lost $1.0M on the trade

[-] 2.1y ago

All out @

71.81

[-] 2.3y ago

Trimmed 40.0K shares @

65.26

[+] 2.6y ago

Initial 125.0K shares @

77.78

Thesis

Go back