Markets

Stonks

@stocks

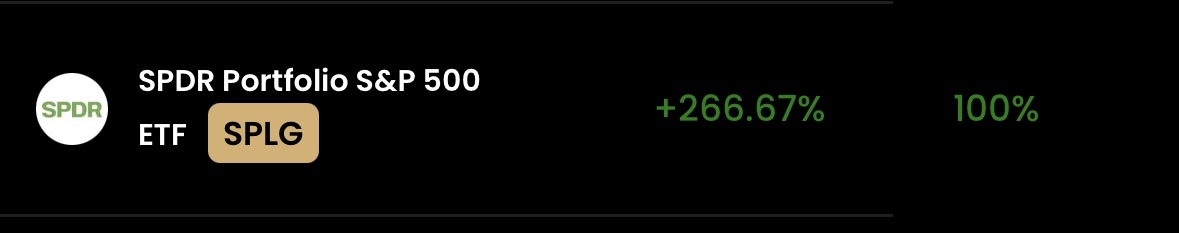

I'm looking to sell my holdings in XLK and SWYNX and invest everything into SPLG. Given its comparable performance to SPY but with a lower expense rat...

Read

More

Thesis

I'm looking to sell my holdings in XLK and SWYNX and invest everything into SPLG. Given its comparable performance to SPY but with a lower expense ratio, I believe this is a smart move for maximizing long-term gains in my Roth IRA.

Go back

Long

@long_gam...

I'm planning to start off by buying shares of SPLG because it's more affordable and has a lower expense ratio compared to SPY. It makes sense to accum...

Read

More

Thesis

I'm planning to start off by buying shares of SPLG because it's more affordable and has a lower expense ratio compared to SPY. It makes sense to accumulate more shares of SPLG initially and then consider SPY later for possible covered calls.

Go back

Scalp

@scalpgan...

I'm planning to trade SPLG as it appears to be a solid option for testing my trading strategies with small amounts. I think its volatility can provide...

Read

More

Thesis

I'm planning to trade SPLG as it appears to be a solid option for testing my trading strategies with small amounts. I think its volatility can provide enough movement to gain practice while potentially making some profit.

Go back

Stonks

@stocks

I'm planning to invest $120 every two weeks into SPLG because it's an S&P500 fund that historically provides great returns. With the low expense ratio...

Read

More

Thesis

I'm planning to invest $120 every two weeks into SPLG because it's an S&P500 fund that historically provides great returns. With the low expense ratio, I feel confident this is a solid long-term hold for my IRA, even though there's a caveat about needing the money sooner.

Go back

Long

@long_gam...

Just bought SPLG as a long-term investment. While it's not immune to downturns, I believe it's a solid bet for growth over the next decade. I've prepa...

Read

More

Thesis

Just bought SPLG as a long-term investment. While it's not immune to downturns, I believe it's a solid bet for growth over the next decade. I've prepared myself for the potential volatility, knowing that patience is key to capturing the rebound when the market stabilizes.

Go back

Long

@long_gam...

I'm planning to consistently invest in SPLG, especially since it's under $100 per share and tracks the S&P500 well. I believe that dollar-cost averagi...

Read

More

Thesis

I'm planning to consistently invest in SPLG, especially since it's under $100 per share and tracks the S&P500 well. I believe that dollar-cost averaging into this ETF will provide a solid foundation for my long-term investment strategy as I accumulate more shares over time.

Go back

Long

@long_gam...

I'm planning to buy SPLG to keep an eye on its daily price movements, which will help me decide the best time to sell later. It's a solid ETF with low...

Read

More

Thesis

I'm planning to buy SPLG to keep an eye on its daily price movements, which will help me decide the best time to sell later. It's a solid ETF with low fees, and I'll also funnel any leftover cash into SWPPX for broader market exposure.

Go back

Long

@long_gam...

I've been eyeing SPLG as a solid ETF choice for safe investment. It mirrors the performance of S&P 500 and seems like a great long-term hold, especial...

Read

More

Thesis

I've been eyeing SPLG as a solid ETF choice for safe investment. It mirrors the performance of S&P 500 and seems like a great long-term hold, especially for someone just starting their investing journey.

Go back

Renaissance

@renaissa...

Trims & Adds

[] Currently up $779.2K

[-] 1.2y ago

Trimmed 22.8K shares @

67.51

[-] 1.4y ago

Trimmed 18.4K shares @

64.14

[-] 1.7y ago

Trimmed 24.5K shares @

61.42

[+] 1.9y ago

Initial 85.5K shares @

55.60

Thesis

Go back