Markets

Degenerate

@wsb

Now that I’ve cashed out on my UVIX position, I fully believe the market will eventually recover to its previous ATH. I'm planning to dollar-cost aver...

Read

More

Thesis

Now that I’ve cashed out on my UVIX position, I fully believe the market will eventually recover to its previous ATH. I'm planning to dollar-cost average into SPXL, capitalizing on the dips until we reach that high again. It’s all about making that money back with a solid strategy.

Go back

Scalp

@scalpgan...

I'm planning to enter a position in SPXL with a strategy that targets drops of 10% from recent highs. This has shown potential in backtests to beat th...

Read

More

Thesis

I'm planning to enter a position in SPXL with a strategy that targets drops of 10% from recent highs. This has shown potential in backtests to beat the S&P500 significantly, and I believe it's worth a shot for some swing trades if we see that drop. Let's see how it plays out.

Go back

Long

@long_gam...

I'm thinking of buying SPXL because it's a 3X leveraged fund that has shown incredible returns since 2008. I believe it offers a solid opportunity for...

Read

More

Thesis

I'm thinking of buying SPXL because it's a 3X leveraged fund that has shown incredible returns since 2008. I believe it offers a solid opportunity for growth, especially if the market trends upward with minimal volatility in the near future. Just need to be cautious and keep an eye on market conditions.

Go back

Posted

269d ago

34.08%

Scalped

•

Bearish

•

Exited

fizzle

@tradetas...

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Made $1.1K in profit

[-] 269d ago

All out @

1.46

[+] 269d ago

Added 10.00 contracts @

1.12

[+] 269d ago

Added 10.00 contracts @

1.07

[+] 269d ago

Added 10.00 contracts @

1.07

[+] 269d ago

Initial 1.00 contracts @

1.08

Trade is closed already

Thesis

Scalping pre-defined conditionals at the money for SPXL.

Go back

Long

@long_gam...

I believe that SPDR S&P 500 ETF (SPXL) is a strong choice due to its significantly lower expense ratio compared to Vanguard's equivalent, making it mo...

Read

More

Thesis

I believe that SPDR S&P 500 ETF (SPXL) is a strong choice due to its significantly lower expense ratio compared to Vanguard's equivalent, making it more cost-effective for holding long term. With no transaction fees, it just makes sense to lean towards SPXL for better returns.

Go back

Stonks

@stocks

I'm assuming the stock market will remain very strong for years to come, and that makes SPXL a compelling buy for me. Given its potential to outperfor...

Read

More

Thesis

I'm assuming the stock market will remain very strong for years to come, and that makes SPXL a compelling buy for me. Given its potential to outperform in a bull market, it's a solid choice for those looking to take advantage of upward momentum.

Go back

Posted

342d ago

45.0%

Swung

•

Bearish

•

Exited

Hersh

@hersh

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

Adding some downside risk for OpEx on Friday and PA below 181 is going to be key for this idea being profitable. This is a contrarian play give all the Trump bullish excitement in the markets

Go back

Hersh

@hersh

Contract:

179 Strike Put for

Nov 08, 24

Adding some downside risk for a dip as we get ready for FOMC and Powell Presser; volatility will be wild so make sure to manage quickly.

Thesis

Adding some downside risk for a dip as we get ready for FOMC and Powell Presser; volatility will be wild so make sure to manage quickly.

Go back

Posted

347d ago

-95.52%

Daytraded

•

Bearish

•

Exited

Hersh

@hersh

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Lost $3.2K on the trade

[-] 345d ago

All out @

0.07

[+] 346d ago

Added 10.00 contracts @

1.02

[+] 347d ago

Initial 10.00 contracts @

2.33

Trade is closed already

Thesis

Adding some downside risk ahead of Powell on the Election excitement as a dip looks very like to end the week

Go back

Scalp

@scalpgan...

I'm feeling pretty confident about SPXL as a 3x leverage ETF for the S&P 500. Given its strong performance and potential for gains in a bullish market...

Read

More

Thesis

I'm feeling pretty confident about SPXL as a 3x leverage ETF for the S&P 500. Given its strong performance and potential for gains in a bullish market, I'm looking to ride this one for some solid future profits.

Go back

Posted

1.0y ago

32.82%

Swung

•

Bullish

•

Exited

Hersh

@hersh

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

As we get ready for NFP tomorrow and CPI | PPI Next week; I am adding some upside risk into the events. Now PA > 157.25 is going to be key along with watching the Middle East Conflict.

Go back

Posted

1.1y ago

58.96%

Swung

•

Bullish

•

Exited

Hersh

@hersh

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

As we get ready for data later in the week, I am adding some SX upside risk into the event; and playing for 163 | 164 ahead.

Go back

Posted

1.1y ago

-69.74%

Daytraded

•

Bullish

•

Exited

Hersh

@hersh

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

EOD play for BUILs to show off to end the day with all that open interest at SPX 5750

Go back

Hersh

@hersh

Contract:

158 Strike Call for

Sep 20, 24

Looking for a run higher ahead of Powell | FOMC tomorrow

Thesis

Looking for a run higher ahead of Powell | FOMC tomorrow

Go back

Posted

1.1y ago

74.29%

Swung

•

Bullish

•

Exited

Hersh

@hersh

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

Betting that tomorrow we get a move higher before the Powell event on Wednesday

Go back

Thesis

Looking for a bounce after the opening drive sell off and price action holding SPX 5440

Go back

Posted

1.2y ago

-97.46%

Swung

•

Bullish

•

Exited

Hersh

@hersh

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

Looking for the continuation play given a Dovish Powell this past week + PCE on deck next Friday; stalk price action at the start of the week if you would like to play this idea

Go back

Thesis

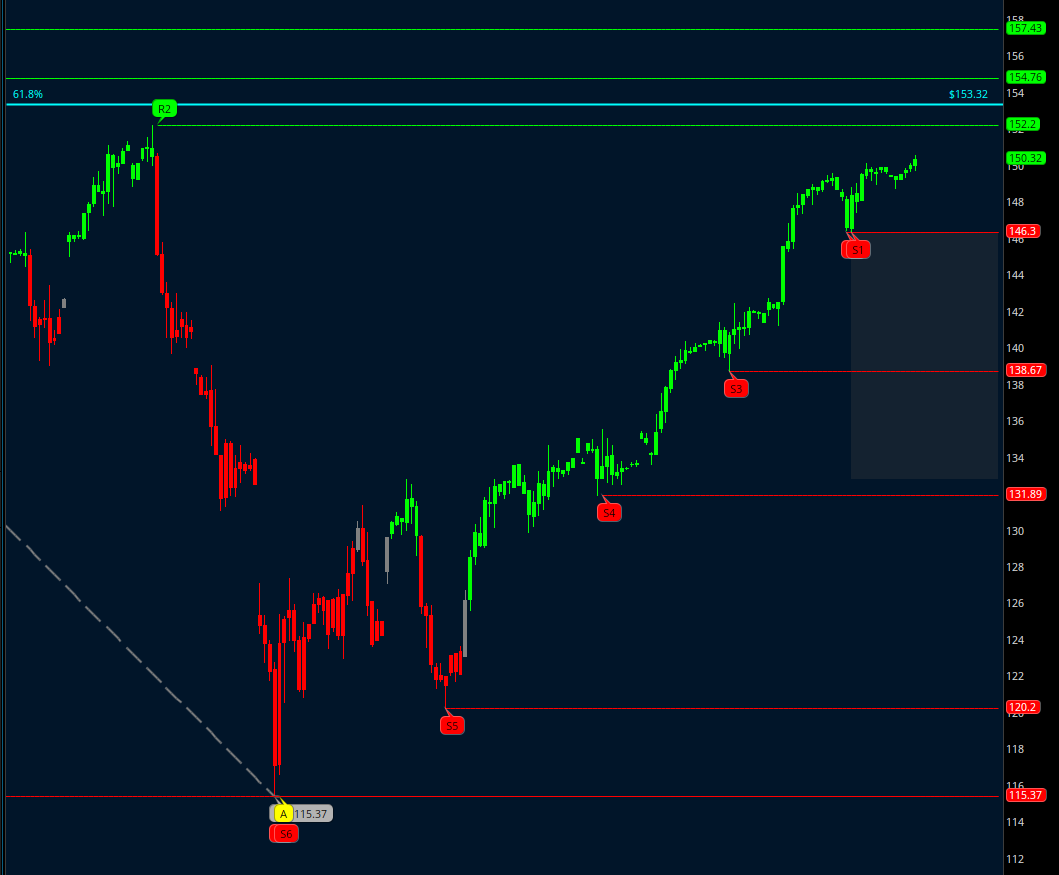

Betting on Powell to say the right things after today's reset ahead of his speech from Jackson Hole tomorrow. Price holding 149.50 and we've got a shot for 153 | 155 for EOW

Go back

Thesis

With Powell scheduled to speak from Jackson Hole on Friday and a slew of data points on deck this week, I am looking for a continuation higher into the event.

Go back

Thesis

Go back