Markets

The

@themarke...

Contract:

91.5 Strike Put for

Apr 11

With the current uncertainty in the bond market and comments suggesting that yields are volatility-prone, I'm leaning towards buying puts on TLT. Ther...

Read

More

Thesis

With the current uncertainty in the bond market and comments suggesting that yields are volatility-prone, I'm leaning towards buying puts on TLT. There's a lot of chatter about potential instability, which can amplify the downward pressure on bonds in the near future.

Go back

Degenerate

@wsb

Contract:

90.5 Strike Call for

Apr 07

Given the current economic climate, I believe that TLT is primed for growth as yields are set to drop, which will likely push the ETF's value up. With...

Read

More

Thesis

Given the current economic climate, I believe that TLT is primed for growth as yields are set to drop, which will likely push the ETF's value up. With many investors shifting towards treasury bonds for security, I'm confident in taking a bullish position with calls on TLT.

Go back

Stonks

@stocks

I think TLT is set to drop further due to rising interest rates and ongoing inflation concerns. With the current market dynamics, it may be a good opp...

Read

More

Thesis

I think TLT is set to drop further due to rising interest rates and ongoing inflation concerns. With the current market dynamics, it may be a good opportunity to short TLT, especially as it's showing signs of weakness towards the $90 mark as a potential floor.

Go back

Long

@long_gam...

I believe that with the Fed likely to cut rates due to an impending recession, TLT presents a solid opportunity as bond prices should increase signifi...

Read

More

Thesis

I believe that with the Fed likely to cut rates due to an impending recession, TLT presents a solid opportunity as bond prices should increase significantly. Bonds typically rally in times of economic downturn, making now a good time to buy into TLT for the swing trade.

Go back

Long

@long_gam...

Contract:

90.5 Strike Call for

Mar 10

I'm betting on TLT calls because I see aggressive activity in the options chain and think we're entering a deflationary cycle. With the economy showin...

Read

More

Thesis

I'm betting on TLT calls because I see aggressive activity in the options chain and think we're entering a deflationary cycle. With the economy showing weakness and potential flight to quality into Treasuries, it feels like a smart move for a swing trade.

Go back

Posted

258d ago

-81.63%

Swung

•

Bullish

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Thesis

Go back

Degenerate

@wsb

Contract:

91 Strike Call for

Mar 17

I'm anticipating a shift in market behavior as investors look for safe havens like bonds during the expected downturn, pushing TLT significantly highe...

Read

More

Thesis

I'm anticipating a shift in market behavior as investors look for safe havens like bonds during the expected downturn, pushing TLT significantly higher. Given the consensus on rate cuts, I'm looking to capitalize on this upward movement in TLT options soon.

Go back

Long

@long_gam...

I'm considering putting $30,000 into TLT ahead of the upcoming CPI and FOMC announcements. Given the current market signals and the outlook for treasu...

Read

More

Thesis

I'm considering putting $30,000 into TLT ahead of the upcoming CPI and FOMC announcements. Given the current market signals and the outlook for treasury pricing, I believe this could lead to potential gains in the near future as inflation expectations adjust.

Go back

Hammad

@hammadha...

Contract:

100 Strike Call for

Jun 20

I am expecting a rally in bonds.

Trims & Adds

[] Currently down $10.9K

[+] 238d ago

Added 200.00 contracts @

0.29

[+] 263d ago

Initial 100.00 contracts @

0.75

Thesis

I am expecting a rally in bonds.

Go back

Long

@long_gam...

Contract:

89 Strike Call for

Dec 31

I'm considering buying TLT calls since there might be potential interest rate cuts in the future. Despite the mixed sentiment in the market, the divid...

Read

More

Thesis

I'm considering buying TLT calls since there might be potential interest rate cuts in the future. Despite the mixed sentiment in the market, the dividends and selling covered calls could also provide a steady income while I wait for the options to play out.

Go back

The

@themarke...

Contract:

89 Strike Put for

Feb 24

I've got a strong feeling based on current trends that TLT is ready for a bounce back. With the anticipated market drop on Monday, it's a great time t...

Read

More

Thesis

I've got a strong feeling based on current trends that TLT is ready for a bounce back. With the anticipated market drop on Monday, it's a great time to consider buying puts to capitalize on the potential volatility.

Go back

Degenerate

@wsb

Contract:

88 Strike Call for

Feb 10

I'm feeling bullish on TLT calls right now because if tariffs do escalate, it'll accelerate global economic instability, driving investors to safer as...

Read

More

Thesis

I'm feeling bullish on TLT calls right now because if tariffs do escalate, it'll accelerate global economic instability, driving investors to safer assets like long-term Treasuries. With the volatility expected, this could be a great opportunity to capitalize on a potential spike in TLT.

Go back

Stonks

@stocks

With the looming trade war and fears of inflation spreading, I see significant downside potential for TLT. The market is primed for a downturn, and I ...

Read

More

Thesis

With the looming trade war and fears of inflation spreading, I see significant downside potential for TLT. The market is primed for a downturn, and I believe that shorting TLT now could potentially lead to good returns as market conditions worsen.

Go back

Thesis

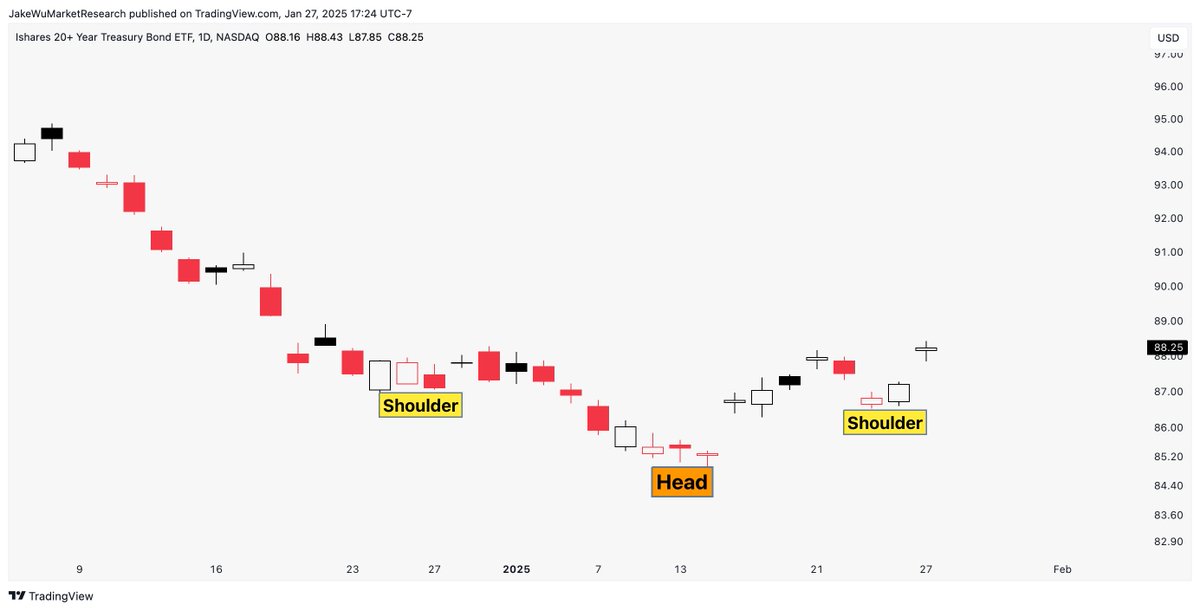

Inverse head & shoulders in bonds starting to play out.

Go back

Long

@long_gam...

I'm jumping into TLT because I believe interest rates are going to drop sharply and quickly. With these Treasuries, I can benefit from a potential dow...

Read

More

Thesis

I'm jumping into TLT because I believe interest rates are going to drop sharply and quickly. With these Treasuries, I can benefit from a potential downturn while also securing a solid yield. If the market does turn against me, at least I've got my Treasuries to fall back on.

Go back

Posted

300d ago

1.68%

Scalped

•

Bearish

•

Exited

Downer

@debdowne...

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

Scalping pre-defined conditionals at the money for TLT.

Go back

Tendies

@tendies

I believe Theralase Technologies has a promising future with TLD-1433 potentially gaining FDA approval soon. The company's upcoming developments could...

Read

More

Thesis

I believe Theralase Technologies has a promising future with TLD-1433 potentially gaining FDA approval soon. The company's upcoming developments could attract big pharma interest and significantly increase its value, making it a solid buy and hold opportunity for new investors.

Go back

Thesis

Bond sentiment is insanely bearish right now. The technical setup is opposite.

Go back

Stonks

@stocks

I think TLT is a solid play right now, especially if rates continue to cut. The monthly dividend yield of around 4.3% is enticing, and if long-term ra...

Read

More

Thesis

I think TLT is a solid play right now, especially if rates continue to cut. The monthly dividend yield of around 4.3% is enticing, and if long-term rates drop, TLT’s price should rise, making it a beneficial hold during this rate cycle.

Go back

Degenerate

@wsb

I believe that TLT is nearing a buy point as the current high yields may not have much more upward movement. Given the economic outlook, I see the pot...

Read

More

Thesis

I believe that TLT is nearing a buy point as the current high yields may not have much more upward movement. Given the economic outlook, I see the potential for this long-term treasury ETF to perform well as inflation stabilizes.

Go back

Long

@long_gam...

With the yields on long-term treasuries at unprecedented levels and inflation still running above target, I believe TLT is set for a solid rebound as ...

Read

More

Thesis

With the yields on long-term treasuries at unprecedented levels and inflation still running above target, I believe TLT is set for a solid rebound as the market adjusts. I'm seeing a potential buy opportunity for the long-term as yields stabilize.

Go back

Degenerate

@wsb

Contract:

85 Strike Call for

Apr 17

I just bought $3000 worth of $85 calls for TLT expiration on 4/17. TLT is at a 5-year low, and with past performance in mind, I believe it's due for a...

Read

More

Thesis

I just bought $3000 worth of $85 calls for TLT expiration on 4/17. TLT is at a 5-year low, and with past performance in mind, I believe it's due for a bounce back to around $90 soon, making this a solid opportunity to double my investment.

Go back

Posted

315d ago

10.0%

Daytraded

•

Bullish

•

Exited

JD_Rock

@jd_rock

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Made $2.9K in profit

[-] 298d ago

All out @

0.52

[+] 298d ago

Added 400.00 contracts @

0.46

[+] 299d ago

Added 200.00 contracts @

0.47

[+] 315d ago

Initial 10.00 contracts @

0.75

Trade is closed already

Thesis

Long calls target entry 85-1/2: In anticipation for next decent rips gap up off support below for treasuries. More aggressive than longer swing, will exit any gaps up this month inside 88.

Go back

Posted

315d ago

-1.86%

Daytraded

•

Bullish

•

Exited

JD_Rock

@jd_rock

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

LONG TLT CALLS 3/2025 93 STRIKE. considering nearer term FEB 88c for shorter swing.

Go back

Tendies

@tendies

I believe Theralase Technologies is poised for significant growth, especially with the upcoming FDA response regarding the Breakthrough Designation fo...

Read

More

Thesis

I believe Theralase Technologies is poised for significant growth, especially with the upcoming FDA response regarding the Breakthrough Designation for Ruvidar. The company has a promising drug targeting bladder cancer with a strong response rate, and if the Breakthrough Designation is approved, the stock could skyrocket from its current price near $0.29 to around $5.71 per share.

Go back

Thesis

Everything I look for when finding reversals suggest bonds have bottomed in the short-term.

Go back

Posted

320d ago

0.13%

Swung

•

Bullish

•

Exited

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Made $2.4K in profit

[-] 305d ago

All out @

0.23

[+] 307d ago

Added 50.0K contracts @

0.20

[+] 314d ago

Added 20.0K contracts @

0.20

[+] 316d ago

Added 5.0K contracts @

0.38

[+] 316d ago

Added 5.0K contracts @

0.41

[+] 320d ago

Initial 1.0K contracts @

0.66

Trade is closed already

Thesis

Go back

Gamma

@gamma

Contract:

87.0 Strike Put for

Mar 21

I recently invested $1.04 million in TLT puts with a strike price of 87.0, expiring on March 21, 2025. This decision comes as the TLT ETF has faced si...

Read

More

Thesis

I recently invested $1.04 million in TLT puts with a strike price of 87.0, expiring on March 21, 2025. This decision comes as the TLT ETF has faced significant declines amid rising Treasury yields and ongoing concerns over inflation and government spending, despite soft inflation data being reported.

Go back

Long

@long_gam...

Contract:

74 Strike Put for

Jan 16, 26

I just bought January 2026 puts at a strike of $74 for TLT to protect my long-term bond position. Given my strategy to hedge against catastrophic loss...

Read

More

Thesis

I just bought January 2026 puts at a strike of $74 for TLT to protect my long-term bond position. Given my strategy to hedge against catastrophic loss while maintaining rebalancing opportunities, I see this as a necessary move to manage risk effectively.

Go back

Long

@long_gam...

I'm considering $TLT at these levels because it tracks the 20-year bond. With the current market volatility and potential shifts in interest rates, it...

Read

More

Thesis

I'm considering $TLT at these levels because it tracks the 20-year bond. With the current market volatility and potential shifts in interest rates, it could be a good opportunity to capitalize on the price movements while managing some risk in my portfolio.

Go back