Markets

Posted

166d ago

-4.57%

Scalped

•

Bullish

•

Exited

JD_Rock

@jd_rock

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

Long for intraday scalp what i call a sizzle lotto trade. Expect can go to zero.

Go back

Degenerate

@wsb

Contract:

35 Strike Call for

May 02

I'm betting on HIMS ahead of their earnings on May 6, especially with the recent news about GLP-1 compounded semaglutide. The stock is breaking out an...

Read

More

Thesis

I'm betting on HIMS ahead of their earnings on May 6, especially with the recent news about GLP-1 compounded semaglutide. The stock is breaking out and the momentum is strong, so I believe there's potential for a significant earnings reaction that could drive the price up further.

Go back

Gnotz

@bulltrad...

Contract:

45 Strike Call for

Jun 20

Trims & Adds

[] Made $396.90 in profit

[-] 214d ago

All out @

3.08

[-] 214d ago

Trimmed 2.00 contracts @

2.96

[+] 215d ago

Initial 5.00 contracts @

2.23

Thesis

Go back

Stonks

@stocks

I'm really bullish on HIMS with the recent surge due to the telehealth access for Wegovy. Regulatory concerns are fading and the supply constraints ar...

Read

More

Thesis

I'm really bullish on HIMS with the recent surge due to the telehealth access for Wegovy. Regulatory concerns are fading and the supply constraints are being addressed. I see this stock continuing to climb further, especially around the $38/$40 levels.

Go back

Long

@long_gam...

With the recent collaboration with Novo Nordisk to enhance obesity care access and affordability, I see a strong growth potential for Hims & Hers. Thi...

Read

More

Thesis

With the recent collaboration with Novo Nordisk to enhance obesity care access and affordability, I see a strong growth potential for Hims & Hers. This partnership will likely attract more customers and boost revenue, making it a solid investment opportunity in the healthcare sector.

Go back

Degenerate

@wsb

I believe HIMS is poised for a significant run-up based on the recent technical analysis suggesting it could break through $30. The recent performance...

Read

More

Thesis

I believe HIMS is poised for a significant run-up based on the recent technical analysis suggesting it could break through $30. The recent performance after using the new pills also indicates potential upward momentum, making this a good opportunity to invest.

Go back

Stonks

@stocks

I'm finding HIMS very attractively valued right now at about $24, especially with their projected growth. Their subscriber growth is impressive, and t...

Read

More

Thesis

I'm finding HIMS very attractively valued right now at about $24, especially with their projected growth. Their subscriber growth is impressive, and they seem poised for significant revenue increase despite the semaglutide sales ban. I believe this stock has strong future potential.

Go back

Degenerate

@wsb

I'm feeling bullish on HIMS due to their massively positive revenue growth projections and strategic moves, such as buying peptide manufacturing facil...

Read

More

Thesis

I'm feeling bullish on HIMS due to their massively positive revenue growth projections and strategic moves, such as buying peptide manufacturing facilities. Their business model is uniquely positioned to thrive, and as they expand product offerings, I'm confident in their long-term success.

Go back

Scalp

@scalpgan...

I'm optimistic about HIMS based on the high volatility filter results, and with a positive price target, I believe it's set up for a strong short-term...

Read

More

Thesis

I'm optimistic about HIMS based on the high volatility filter results, and with a positive price target, I believe it's set up for a strong short-term move. The strategy has been working well for me recently, and I'm eager to take advantage of the current market conditions.

Go back

Degenerate

@wsb

I just bought shares of HIMS because they’re launching Eli Lilly's Zepbound on their telehealth platform, and the stock is already reacting positively...

Read

More

Thesis

I just bought shares of HIMS because they’re launching Eli Lilly's Zepbound on their telehealth platform, and the stock is already reacting positively. With the potential for Q1 reports to exceed expectations, I think we might see significant gains as the stock trends upward in the coming months.

Go back

Scalp

@scalpgan...

I've had solid gains trading HIMS recently. The swings on this stock have been consistent, and I confidently anticipate a price movement of about $0.5...

Read

More

Thesis

I've had solid gains trading HIMS recently. The swings on this stock have been consistent, and I confidently anticipate a price movement of about $0.5 to $1 based on the daily trends. I believe it could continue to perform well in the near future.

Go back

Stonks

@stocks

With Hims and Hers officially being added to the S&P 400, I see it as a potential catalyst for a price increase, especially with index funds now requi...

Read

More

Thesis

With Hims and Hers officially being added to the S&P 400, I see it as a potential catalyst for a price increase, especially with index funds now required to buy shares. The current oversold condition and high short interest could lead to significant upward movement as shorts cover their positions.

Go back

Gnotz

@bulltrad...

Contract:

40 Strike Call for

Apr 17

Thesis

Go back

Long

@long_gam...

I believe HIMS is poised for a recovery as they continue to offer and prescribe obesity drugs with personalized dosing. The recent commentary suggests...

Read

More

Thesis

I believe HIMS is poised for a recovery as they continue to offer and prescribe obesity drugs with personalized dosing. The recent commentary suggests that they won’t lose business and may bounce back from recent losses.

Go back

Stonks

@stocks

I believe HIMS is positioned well despite facing recent hurdles with the FDA. Its core services and strong brand presence will continue to drive expon...

Read

More

Thesis

I believe HIMS is positioned well despite facing recent hurdles with the FDA. Its core services and strong brand presence will continue to drive exponential revenue growth in 2024. The market seems to be undervaluing its potential, making this a solid long-term investment opportunity.

Go back

Stonks

@stocks

I believe Hims & Hers is currently undervalued following its recent stock drop. With strong revenue growth and a solid market presence outside the GLP...

Read

More

Thesis

I believe Hims & Hers is currently undervalued following its recent stock drop. With strong revenue growth and a solid market presence outside the GLP-1 sector, I'm considering buying shares around $40 because the potential for recovery seems significant despite recent volatility.

Go back

Degenerate

@wsb

Contract:

47 Strike Put for

Feb 28

I believe there's a strong chance that HIMS will crush earnings, but I'm cautious about the guidance that follows. The current market dynamics, especi...

Read

More

Thesis

I believe there's a strong chance that HIMS will crush earnings, but I'm cautious about the guidance that follows. The current market dynamics, especially with competition from Novo, make me think puts could be a smart hedge against potential volatility.

Go back

Scalp

@scalpgan...

I'm really bullish on Hims & Hers after seeing their impressive earnings forecasts and potential for growth in revenue due to their new product releas...

Read

More

Thesis

I'm really bullish on Hims & Hers after seeing their impressive earnings forecasts and potential for growth in revenue due to their new product releases. Even with recent volatility, I believe the stock is set to rebound strongly in the coming months, making it an attractive play for the swing traders.

Go back

The

@themarke...

I'm confident that HIMS will rebound sharply next week after the earnings report, especially considering the minimal impact the FDA's announcement has...

Read

More

Thesis

I'm confident that HIMS will rebound sharply next week after the earnings report, especially considering the minimal impact the FDA's announcement has on future growth. The company has diversified streams and is positioned well for long-term success, so I see it as a promising buy right now.

Go back

Thesis

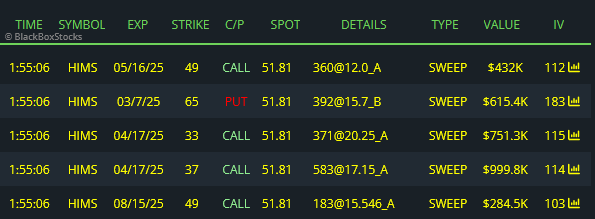

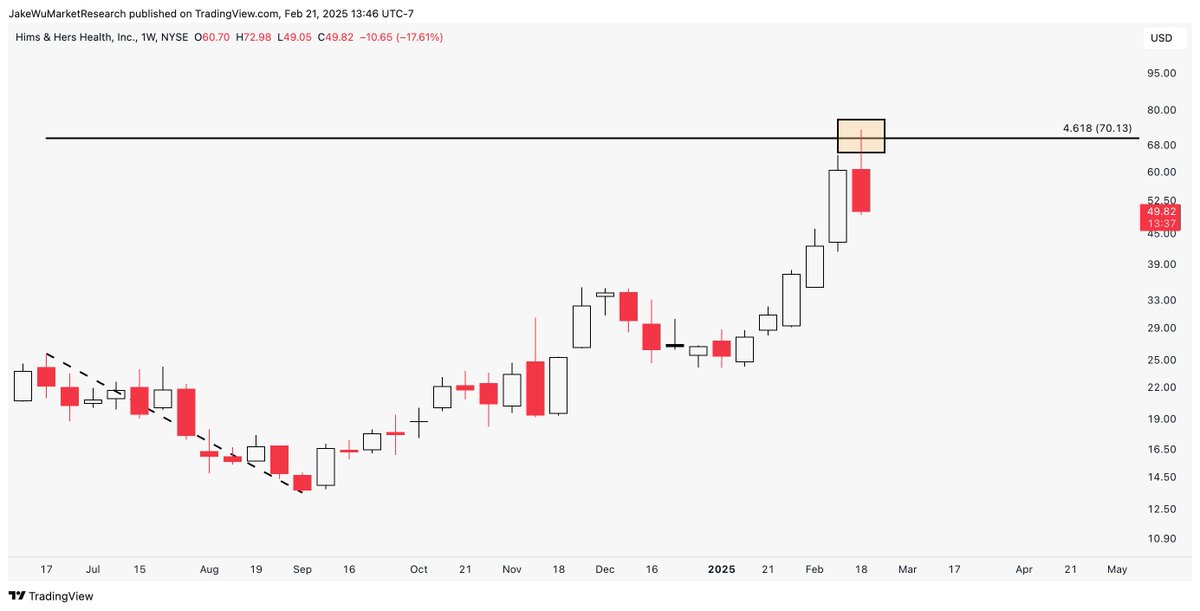

A hard rejection at the 4.618 Fib extension this week.

Go back

itrader001

@itrader0...

Contract:

60 Strike Call for

Mar 21

Trims & Adds

[] Currently down $8.3K

[+] 280d ago

Added 10.00 contracts @

3.47

[+] 283d ago

Initial 10.00 contracts @

4.84

Thesis

Go back

Stonks

@stocks

With the end of the Ozempic shortage, HIMS is facing a significant drop in demand for its compounded semaglutide. As the market adjusts, I believe it'...

Read

More

Thesis

With the end of the Ozempic shortage, HIMS is facing a significant drop in demand for its compounded semaglutide. As the market adjusts, I believe it's a solid opportunity to short HIMS as the stock is likely to continue its downward trend amidst ongoing volatility.

Go back

Degenerate

@wsb

I believe HIMS is a strong play because it continues to reach new highs. Given its disruptive business model and recent performance, holding onto this...

Read

More

Thesis

I believe HIMS is a strong play because it continues to reach new highs. Given its disruptive business model and recent performance, holding onto this stock seems to be the best strategy for future gains.

Go back

Degenerate

@wsb

Contract:

42.5 Strike Call for

Feb 21

I see potential in HIMS as there seems to be renewed interest around weight loss drugs, and despite the political noise, I believe the stock can conti...

Read

More

Thesis

I see potential in HIMS as there seems to be renewed interest around weight loss drugs, and despite the political noise, I believe the stock can continue its upward momentum, especially with their recent growth due to ads and political backing.

Go back

Scalp

@scalpgan...

I’m planning to buy shares in HIMS as I believe it's a core position that I can hold and potentially see significant growth over the next few years. W...

Read

More

Thesis

I’m planning to buy shares in HIMS as I believe it's a core position that I can hold and potentially see significant growth over the next few years. With my current focus and the volatility in the market, it's time to invest in strong fundamentals.

Go back

Thesis

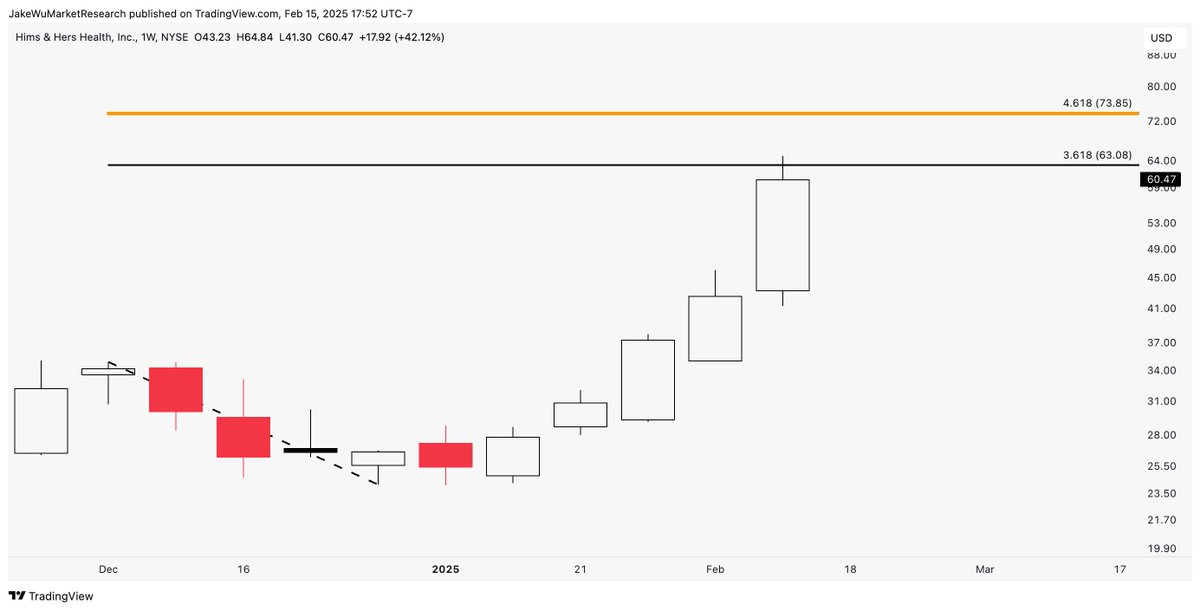

The 4.618 extension is above at $73.85 if this still have juice left.

Go back

Long

@long_gam...

I just bought into HIMS because I see strong potential with their subscription model and rapid user growth. Since they serve a large market and recent...

Read

More

Thesis

I just bought into HIMS because I see strong potential with their subscription model and rapid user growth. Since they serve a large market and recently gained traction from their Superbowl ad, I believe there's room for further revenue increase in the coming months.

Go back