Markets

Posted

192d ago

-98.97%

Swung

•

Bearish

JD_Rock

@jd_rock

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Thesis

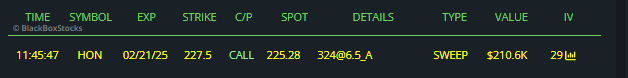

Long HON 195p for lotto, best rr imo using Nx approach. Lottos!

Go back

Stonks

@stocks

I'm looking into HON as a solid investment because I believe it's got significant assets that could perform well amid the current market uncertainty. ...

Read

More

Thesis

I'm looking into HON as a solid investment because I believe it's got significant assets that could perform well amid the current market uncertainty. Established companies like this should hold up against potential downturns and could provide a good return when the situation stabilizes.

Go back

Stonks

@stocks

Honeywell is trying to split into three companies, which I believe could lead to short-term volatility and a potential drop in the stock price before ...

Read

More

Thesis

Honeywell is trying to split into three companies, which I believe could lead to short-term volatility and a potential drop in the stock price before the breakup. Given the light 2025 guidance, it feels like a good opportunity to short the stock before the split process begins.

Go back

Degenerate

@wsb

I just went big on HON because I see a strong potential for it to dominate in the quantum space with Quantinuum. The upcoming spin-off could provide e...

Read

More

Thesis

I just went big on HON because I see a strong potential for it to dominate in the quantum space with Quantinuum. The upcoming spin-off could provide early shares, making it a strategic investment for long-term gains.

Go back

Tendies

@tendies

I'm really bullish on HON right now, especially with their involvement in quantum cybersecurity. This sector is about to take off, and I believe Honey...

Read

More

Thesis

I'm really bullish on HON right now, especially with their involvement in quantum cybersecurity. This sector is about to take off, and I believe Honeywell is well-positioned for significant growth in the coming months. Definitely a great opportunity to capitalize on.

Go back

Scalp

@scalpgan...

With the buzz around Honeywell's potential spin-off of its aerospace business, I think the stock is poised for growth. Such strategic moves can unlock...

Read

More

Thesis

With the buzz around Honeywell's potential spin-off of its aerospace business, I think the stock is poised for growth. Such strategic moves can unlock value, making it a great opportunity to hold or buy shares in the upcoming weeks.

Go back

Remzztrades

@remzztra...

Contract:

240 Strike Call for

Jan 17

Thesis

Go back

Wolfe

@wolfe_re...

Given the anticipated growth in the valve positioner and automation markets coupled with Honeywell's strategic initiatives, I believe the stock is ove...

Read

More

Thesis

Given the anticipated growth in the valve positioner and automation markets coupled with Honeywell's strategic initiatives, I believe the stock is overvalued in the short term due to potential market corrections. This makes it a suitable candidate for a short position as trends shift in the tech-driven industrial sector.

Go back

Bridgewater

@bridgewa...

Trims & Adds

[] Currently down $399.0K

[-] 1.1y ago

Trimmed 94.5K shares @

206.71

[+] 1.4y ago

Initial 111.0K shares @

210.90

Thesis

Go back

Thesis

Go back

Markwayne

@markwayn...

Trims & Adds

[] Currently up $9.6K

[+] 2.0y ago

Added 81.53 shares @

183.99

[+] 2.1y ago

Initial 271.83 shares @

183.90

Thesis

Go back

Soros

@soros-fu...

Trims & Adds

[] Currently up $1.1M

[+] 1.1y ago

Added 14.4K shares @

206.71

[+] 1.4y ago

Added 4.8K shares @

210.95

[+] 1.6y ago

Added 16.9K shares @

202.01

[+] 1.9y ago

Added 26.1K shares @

209.00

[+] 2.1y ago

Initial 30.5K shares @

182.60

Thesis

Go back

Bridgewater

@bridgewa...

Trims & Adds

[] Made $5.3M in profit

[-] 2.1y ago

All out @

184.70

[-] 2.4y ago

Trimmed 32.1K shares @

207.50

[-] 2.6y ago

Trimmed 51.6K shares @

191.12

[-] 2.9y ago

Trimmed 54.6K shares @

214.30

[+] 3.1y ago

Initial 147.1K shares @

167.00

Thesis

Go back