Markets

Posted

290d ago

22.04%

Swung

•

Bullish

•

Exited

Michael

@clockwor...

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

SymbolnKWEBnCall/PutnCALLnContract DetailsnStrike: 33.0nExpiration: 3/21/2025nTotal Prems: 519.83KnTotal Vol: 3.95KnStrike Stock Diff(%): 4.55%nStrike Stock Diff($): 1.43nn great play here

Go back

SAD

@SadTrade...

Contract:

32 Strike Call for

Mar 21

13 Orders, 2.2 mill premium whales positioning.

Trims & Adds

[] Made $474.50 in profit

[-] 287d ago

All out @

2.00

[-] 287d ago

Trimmed 5.00 contracts @

2.03

[+] 291d ago

Initial 10.00 contracts @

1.54

Thesis

13 Orders, 2.2 mill premium whales positioning.

Go back

Gamma

@gamma

Contract:

33.0 Strike Call for

Mar 21

I just invested 519.83K into KWEB calls with a strike of 33.0, expiring on 2025-03-21, betting on the resurgence of Chinese tech stocks as major inves...

Read

More

Thesis

I just invested 519.83K into KWEB calls with a strike of 33.0, expiring on 2025-03-21, betting on the resurgence of Chinese tech stocks as major investors pivot back to this sector amid positive economic signals and renewed confidence following aggressive stimulus measures from the Chinese government.

Go back

Thesis

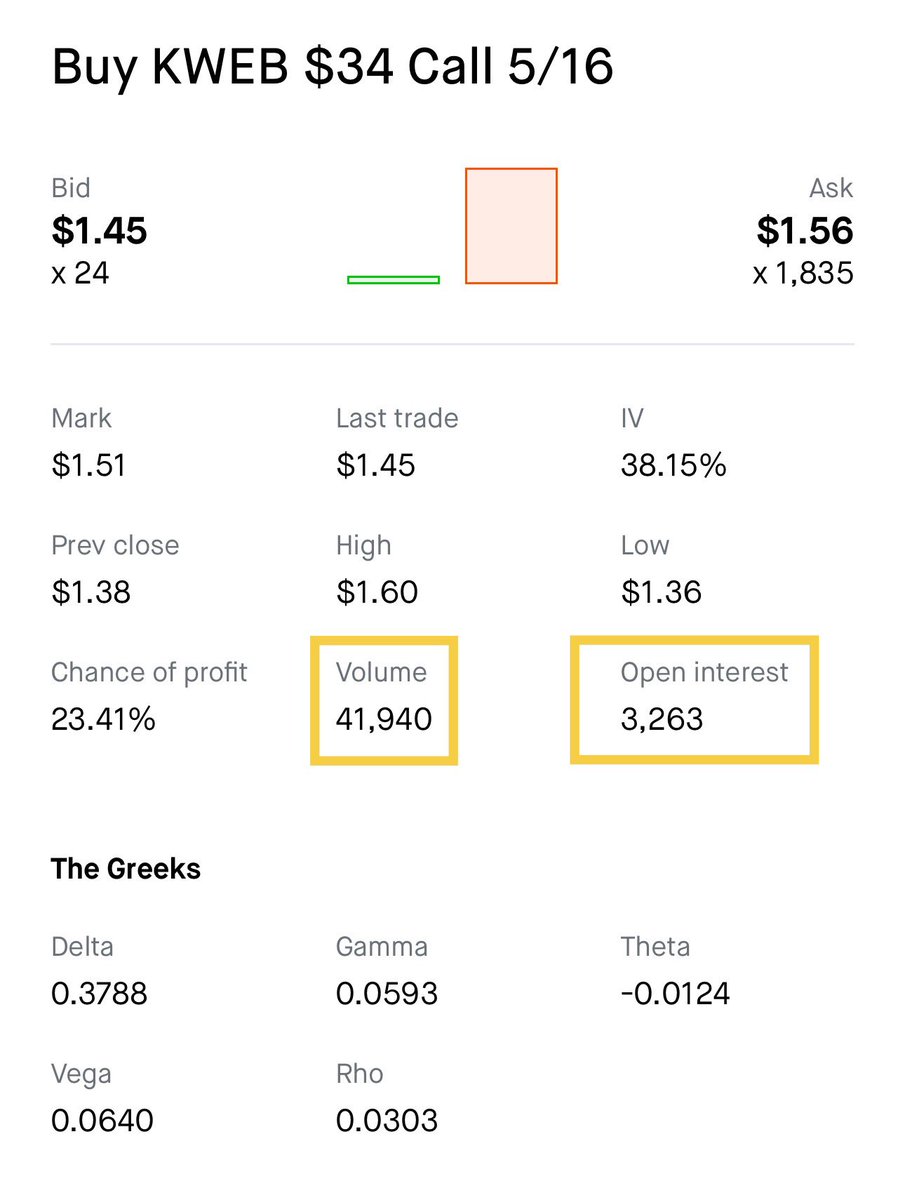

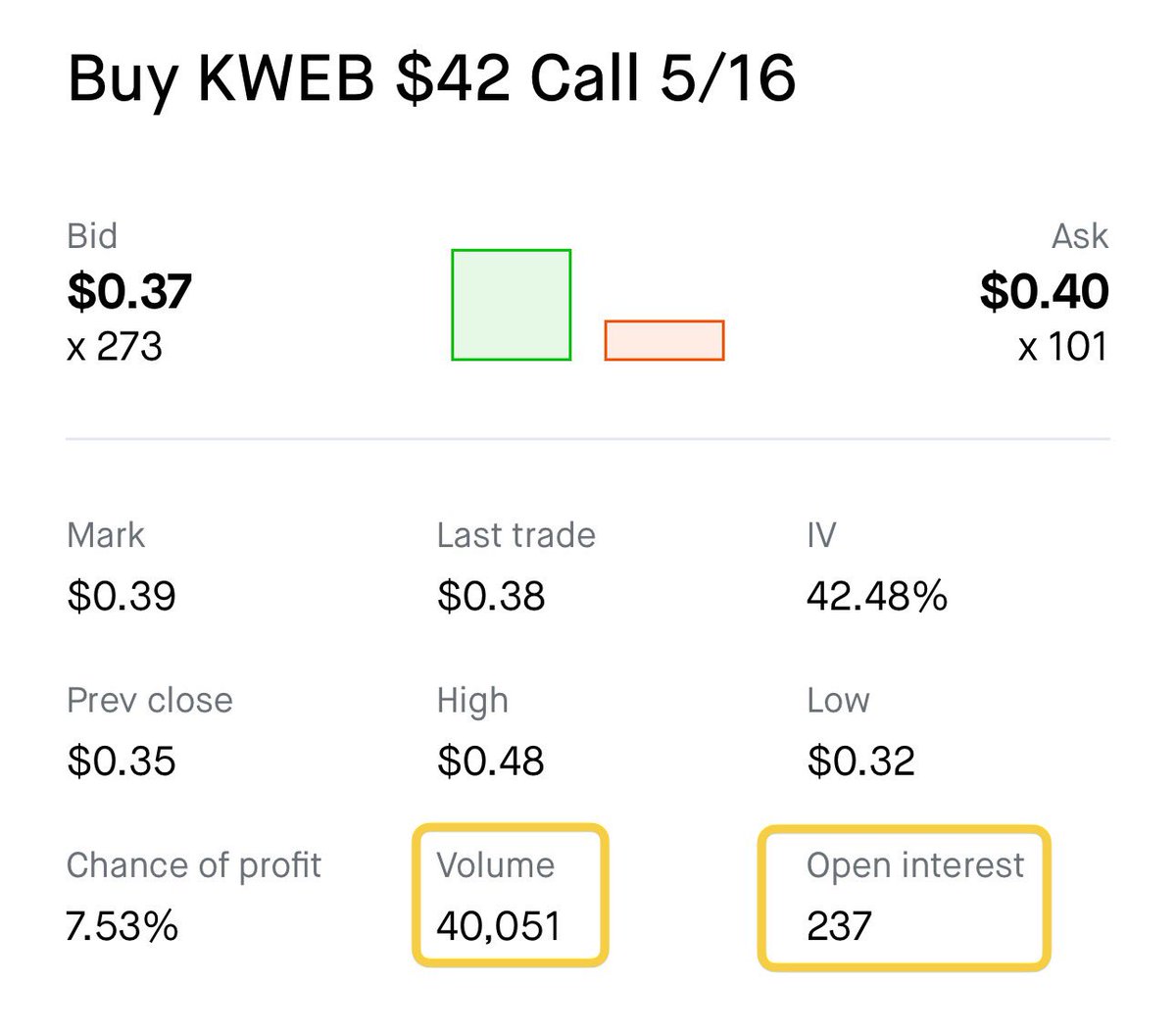

This may be one of the biggest discrepancies I’ve seen between Volume & OI.

Go back

Thesis

Go back

SAD

@SadTrade...

Contract:

34 Strike Call for

May 16

10 + contracts 1.7 mill premiums

Thesis

10 + contracts 1.7 mill premiums

Go back

Thesis

Beautiful setup into next week.

Go back

Gnotz

@bulltrad...

Contract:

45 Strike Call for

Jan 15, 27

long term swing i think can 10x

Thesis

long term swing i think can 10x

Go back

Gnotz

@bulltrad...

Contract:

30.5 Strike Put for

Dec 20, 24

Thesis

Go back

Gnotz

@bulltrad...

Contract:

40 Strike Call for

May 16

Thesis

Go back

Gnotz

@bulltrad...

Contract:

40 Strike Call for

May 16

starter position swing CHINA CONFERENCE TOMORROW

Thesis

starter position swing CHINA CONFERENCE TOMORROW

Go back

Gamma

@gamma

Contract:

31.0 Strike Put for

Jan 17

With recent news highlighting a loss of investor optimism in China's tech sector, I've opted to put $1.37M into KWEB puts, set for a strike of $31.0 a...

Read

More

Thesis

With recent news highlighting a loss of investor optimism in China's tech sector, I've opted to put $1.37M into KWEB puts, set for a strike of $31.0 and expiration on 2025-01-17. The potential for a prolonged recovery in Chinese stocks amid economic uncertainty makes this a strategic hedge.

Go back

Degenerate

@wsb

I'm looking at KWEB and FXI again because the plan is based on super low PE ratios. I believe these stocks have potential for growth, especially after...

Read

More

Thesis

I'm looking at KWEB and FXI again because the plan is based on super low PE ratios. I believe these stocks have potential for growth, especially after my previous experience. I'm ready to buy in for a swing trade.

Go back

Posted

1.1y ago

119%

Daytraded

•

Bearish

•

Exited

JD_Rock

@jd_rock

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

short the to seek return by long 35p for 10/4 to get gap fill entry is a bit steep at .70

Go back

Thesis

Go back

Thesis

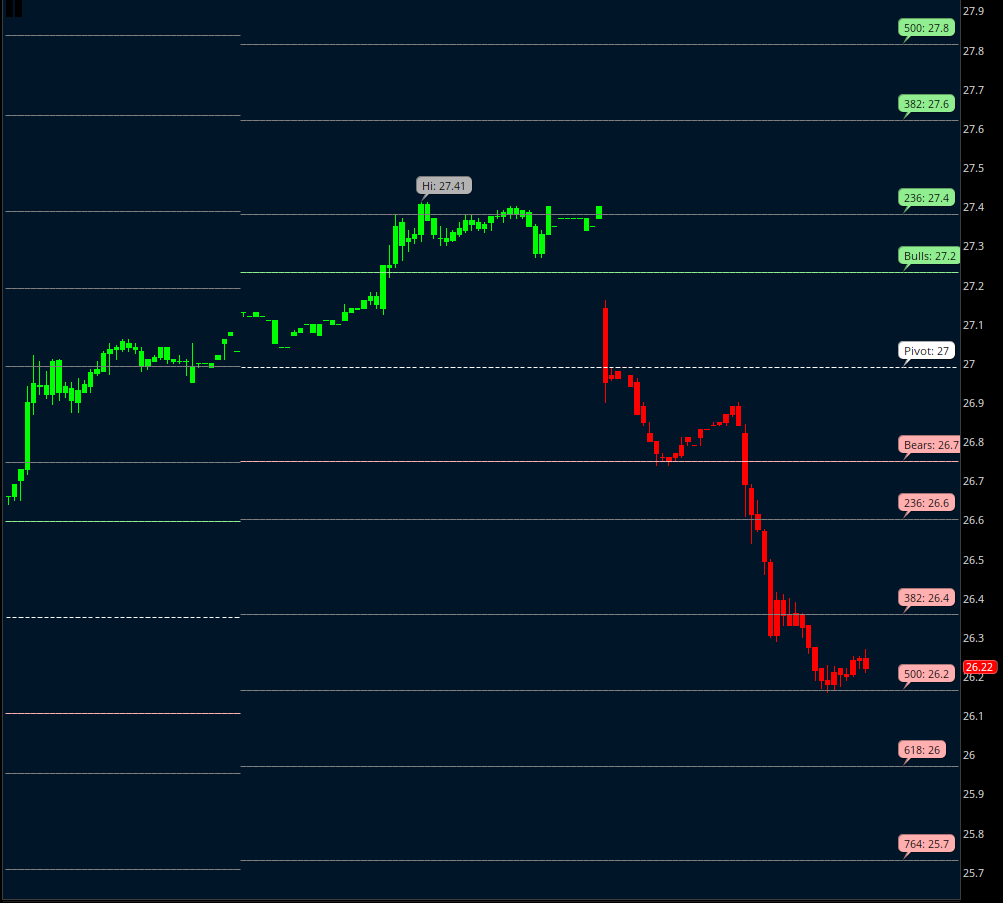

This idea is based on unsual options activity and price finding support at 26.20; I am willing to give it room down to 25.75 if it needs it for a bounce play back to 27.50 gap above for 1st target.

Go back

Two

@two-sigm...

Trims & Adds

[] Currently up $3.9M

[-] 1.1y ago

Trimmed 3.2K shares @

34.02

[+] 1.4y ago

Initial 600.0K shares @

27.10

Thesis

Go back

Appaloosa

@appaloos...

Trims & Adds

[] Currently up $30.2M

[-] 1.1y ago

Trimmed 725.0K shares @

34.02

[+] 1.4y ago

Added 1.0M shares @

27.10

[+] 1.6y ago

Initial 3.5M shares @

26.84

Thesis

Go back

Renaissance

@renaissa...

Trims & Adds

[] Made $578.5K in profit

[-] 1.1y ago

All out @

33.93

[+] 1.4y ago

Added 24.4K shares @

27.10

[-] 1.6y ago

Trimmed 55.9K shares @

26.84

[-] 1.9y ago

Trimmed 18.0K shares @

26.07

[+] 2.1y ago

Initial 144.3K shares @

27.35

Thesis

Go back

Point72

@point72-...

Trims & Adds

[] Lost $38.8K on the trade

[-] 1.6y ago

All out @

26.25

[+] 1.9y ago

Added 55.6K shares @

26.07

[+] 2.1y ago

Initial 44.4K shares @

27.35

Thesis

Go back

Thesis

Go back

Soros

@soros-fu...

Trims & Adds

[] Lost $5.4M on the trade

[-] 1.6y ago

All out @

26.25

[+] 1.9y ago

Added 92.8K shares @

26.07

[-] 2.1y ago

Trimmed 167.8K shares @

27.35

[+] 2.4y ago

Added 350.0K shares @

26.93

[-] 2.6y ago

Trimmed 1.3M shares @

31.19

[+] 2.9y ago

Initial 2.1M shares @

31.80

Thesis

Go back