Markets

Long

@long_gam...

I see OXY as a solid long-term play given its strong cash generation capabilities and management's commitment to reducing debt while improving carbon ...

Read

More

Thesis

I see OXY as a solid long-term play given its strong cash generation capabilities and management's commitment to reducing debt while improving carbon capture technology. With potential for higher oil prices and solid fundamentals, I believe this stock can be a cash machine for investors.

Go back

Goldman

@goldman_...

Given the current challenges Occidental Petroleum faces and the broader market conditions, I believe OXY is overvalued and poised for further decline....

Read

More

Thesis

Given the current challenges Occidental Petroleum faces and the broader market conditions, I believe OXY is overvalued and poised for further decline. With significant pressure from competition and mixed quarterly results, I see a strong opportunity for a short position in the near term.

Go back

Degenerate

@wsb

Just bought shares of Occidental Petroleum after seeing Buffett scoop up over 763,000 shares amid a significant sell-off. With Berkshire holding 28.2%...

Read

More

Thesis

Just bought shares of Occidental Petroleum after seeing Buffett scoop up over 763,000 shares amid a significant sell-off. With Berkshire holding 28.2%, I'm betting on a rebound as oil prices stabilize. This dip seems like a prime opportunity to get in before the next upswing.

Go back

The

@themarke...

I just bought more shares of Occidental Petroleum (OXY) after seeing Buffett increase his position. There's potential for growth in the oil sector, es...

Read

More

Thesis

I just bought more shares of Occidental Petroleum (OXY) after seeing Buffett increase his position. There's potential for growth in the oil sector, especially with the current market dynamics and geopolitical factors in play. I'm optimistic about its performance moving forward.

Go back

Goldman

@goldman_...

Given Occidental Petroleum's recent decline and potential for recovery, alongside Warren Buffett's continued investments despite recent challenges, I ...

Read

More

Thesis

Given Occidental Petroleum's recent decline and potential for recovery, alongside Warren Buffett's continued investments despite recent challenges, I believe OXY presents an opportunity for a short position as market sentiment may remain cautious, potentially leading to further downside in the stock's price in the near term.

Go back

Karma

@karma

Contract:

49 Strike Call for

Jan 31

Thesis

Go back

Posted

328d ago

-56.65%

Daytraded

•

Bullish

•

Exited

coco

@coco.cub...

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

Go back

Scalp

@scalpgan...

I just saw that Warren Buffett scooped up shares of Occidental Petroleum five times in one week. This kind of backing from such a renowned investor in...

Read

More

Thesis

I just saw that Warren Buffett scooped up shares of Occidental Petroleum five times in one week. This kind of backing from such a renowned investor indicates a strong belief in the future growth of OXY, making it a solid long-term investment choice.

Go back

Degenerate

@wsb

I just upped my position in OXY after seeing Buffett's recent buy. The market seems down on it, but I believe he's betting on a rebound in energy dema...

Read

More

Thesis

I just upped my position in OXY after seeing Buffett's recent buy. The market seems down on it, but I believe he's betting on a rebound in energy demand. It feels like a solid long-term hold with strong fundamentals supporting it.

Go back

itrader001

@itrader0...

Oil and related shares under pressure

Thesis

Oil and related shares under pressure

Go back

Degenerate

@wsb

I just bought a significant amount of OXY shares, as I believe there's potential for a recovery. With the upcoming cold winter months impacting oil pr...

Read

More

Thesis

I just bought a significant amount of OXY shares, as I believe there's potential for a recovery. With the upcoming cold winter months impacting oil prices, I’m holding out for gains as the market stabilizes.

Go back

Thesis

Falling wedge on the weekly candle chart with the MACD curling up.

Go back

Long

@long_gam...

I just bought some OXY because it's come down from its highs and is currently undervalued with a low P/E ratio and a solid dividend. Plus, the managem...

Read

More

Thesis

I just bought some OXY because it's come down from its highs and is currently undervalued with a low P/E ratio and a solid dividend. Plus, the management seems strong, and I'm betting that oil will remain a significant cash cow moving forward.

Go back

Thesis

Falling wedge on the weekly candle chart as the MACD curls to the upside & RSI prints positive divergence.

Go back

Karma

@karma

Contract:

55 Strike Call for

Nov 22, 24

Trims & Adds

[] Currently down $464.00

[-] 350d ago

Trimmed 6.00 contracts @

0.01

[+] 1.1y ago

Initial 10.00 contracts @

0.47

Thesis

Go back

PeloSwing

@peloswin...

Contract:

53 Strike Call for

Nov 15, 24

OXY inverse head and shoulders on the daily chart and has based out beautifully. starting to curl this morning. loving energy names at these levels. r...

Read

More

Thesis

OXY inverse head and shoulders on the daily chart and has based out beautifully. starting to curl this morning. loving energy names at these levels. room up to test the 50 MA as well

Go back

Posted

1.1y ago

-49.39%

Swung

•

Bullish

•

Exited

Hersh

@hersh

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trims & Adds

[] Lost $527.00 on the trade

[-] 1.1y ago

All out @

0.27

[+] 1.1y ago

Added 10.00 contracts @

0.32

[+] 1.1y ago

Initial 10.00 contracts @

0.74

Trade is closed already

Thesis

I am liking this OXY setup for a move back to 55+; Pa > 52 is key for this play to be profitable

Go back

Posted

1.2y ago

-91.27%

Swung

•

Bullish

•

Exited

AMCGME

@amcgme

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Trade is closed already

Thesis

In case of Israel retaliation on Iran , oil will pump

Go back

sanemi

@sanemi

Contract:

55 Strike Call for

Oct 18, 24

this is a swing play

Thesis

this is a swing play

Go back

Degenerate

@wsb

I'm really bullish on OXY right now, especially with Buffett piling in. Energy is on an upward trajectory and OXY has a solid balance sheet. It seems ...

Read

More

Thesis

I'm really bullish on OXY right now, especially with Buffett piling in. Energy is on an upward trajectory and OXY has a solid balance sheet. It seems poised for significant gains in the near future, especially with the broader market trend moving in our favor.

Go back

Degenerate

@wsb

I'm holding OXY long-term because I see it as a solid investment based on its fundamentals and energy sector dynamics. I'm not just trading for quick ...

Read

More

Thesis

I'm holding OXY long-term because I see it as a solid investment based on its fundamentals and energy sector dynamics. I'm not just trading for quick gains; I genuinely believe in this company's potential for future growth.

Go back

sanemi

@sanemi

Contract:

54 Strike Call for

Oct 11, 24

Thesis

Go back

Thesis

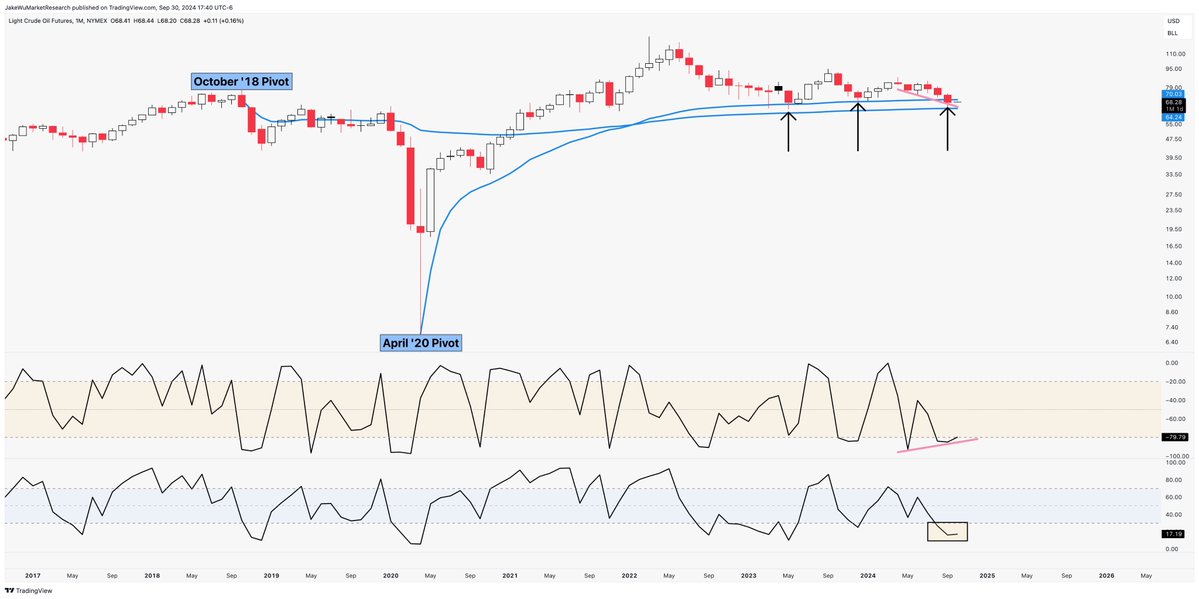

Got the Williams % Range divergence print w/ an extremely oversold RSI at a historical bounce spot. About the highest probability setup we can get for an upside move from here.

Go back

Posted

1.2y ago

-22.52%

Invested

•

Bullish

OG

@ogpennyd...

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Thesis

$OXY looks good here around $50. With China stimulating their economy I expect oil to hold its strength in the near - long term regardless of what happens in the U.S. Demand should not go anywhere anytime soon.

Go back

PeloSwing

@peloswin...

Contract:

52 Strike Call for

Nov 01, 24

Bought the 11/1 52 Calls on $OXYrnrnGood call flow and a value name overall.

Thesis

Bought the 11/1 52 Calls on $OXYrnrnGood call flow and a value name overall.

Go back

Thesis

Go back

Karma

@karma

Contract:

53 Strike Call for

Oct 04, 24

Thesis

Go back