Markets

@althanisaif2514

Noob

Joined August 2024

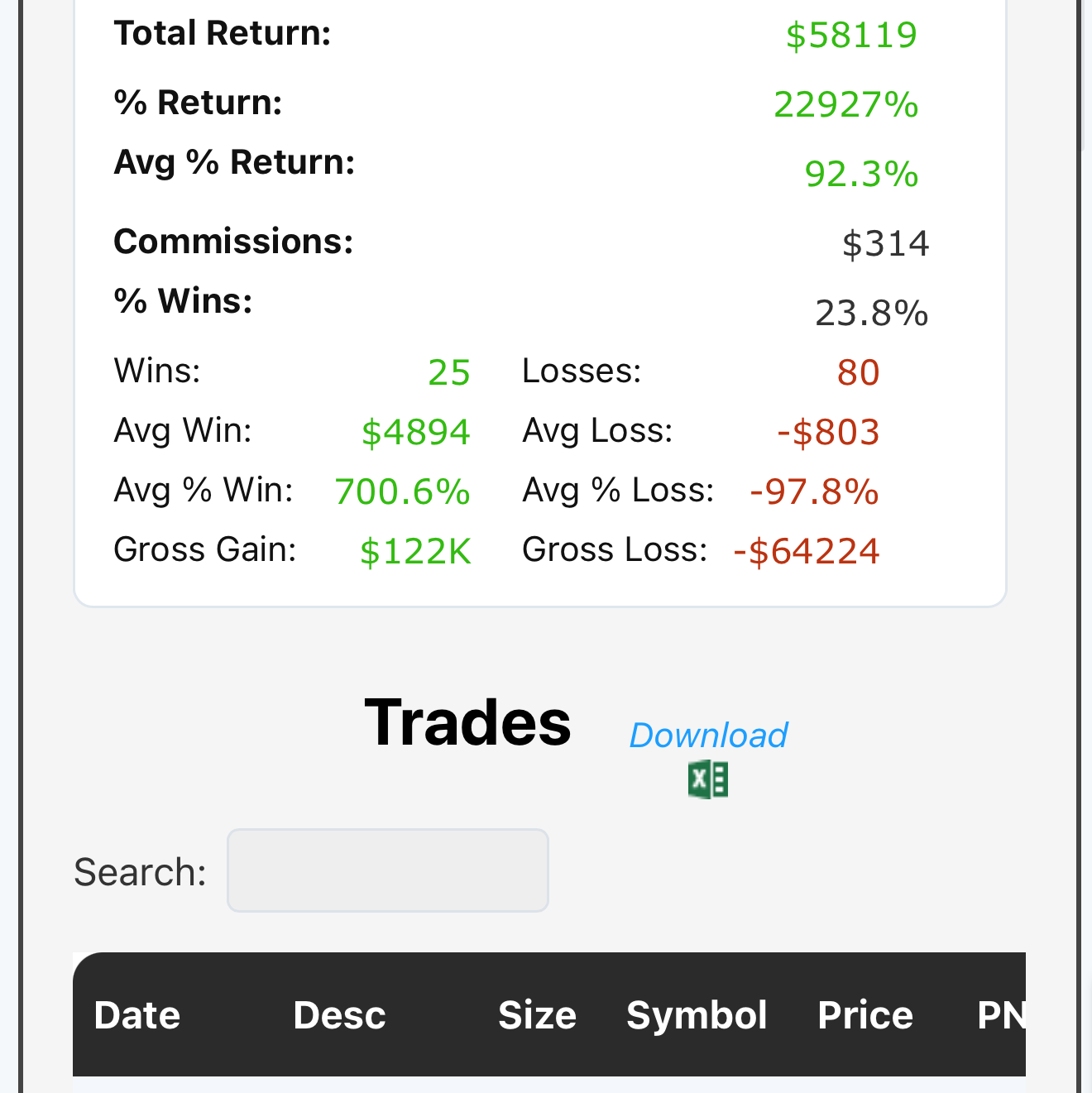

Performance

24

# Trades

9.1%

Win Rate

-58.7%

Avg Gain

-420.1%

Total Gains

-421.4%

S&P Beat

Saif vs S&P 500

Saif

@althanis...

Contract:

370 Strike Call for

Nov 15, 24

450

Thesis

450

Go back

Saif

@althanis...

Contract:

140 Strike Put for

Oct 04, 24

Thesis

Go back

Saif

@althanis...

Contract:

235 Strike Call for

Oct 04, 24

Thesis

Go back

Saif

@althanis...

Contract:

250 Strike Put for

Sep 27, 24

Thesis

Go back

Saif

@althanis...

Contract:

700 Strike Put for

Sep 27, 24

Thesis

Go back

Saif

@althanis...

Contract:

180 Strike Call for

Sep 27, 24

Thesis

Go back

Saif

@althanis...

Contract:

474 Strike Put for

Aug 30, 24

Thesis

Go back

Saif

@althanis...

Contract:

320 Strike Put for

Aug 30, 24

Thesis

Go back

Saif

@althanis...

Contract:

260 Strike Put for

Aug 30, 24

Thesis

Go back

Saif

@althanis...

Contract:

75 Strike Put for

Aug 30, 24

Thesis

Go back

Saif

@althanis...

Contract:

63 Strike Put for

Aug 30, 24

Thesis

Go back

Saif

@althanis...

Contract:

6.5 Strike Put for

Aug 30, 24

Thesis

Go back

Saif

@althanis...

Contract:

27 Strike Call for

Aug 30, 24

Thesis

Go back

Thesis

nHedge

Go back

Saif

@althanis...

Contract:

139 Strike Call for

Aug 23, 24

2. Hedging with Call Optionsnn- Objective: Offset potential losses from puts by capitalizing on upward movement.n- Action:n1. Buy Call Options: Purcha...

Read

More

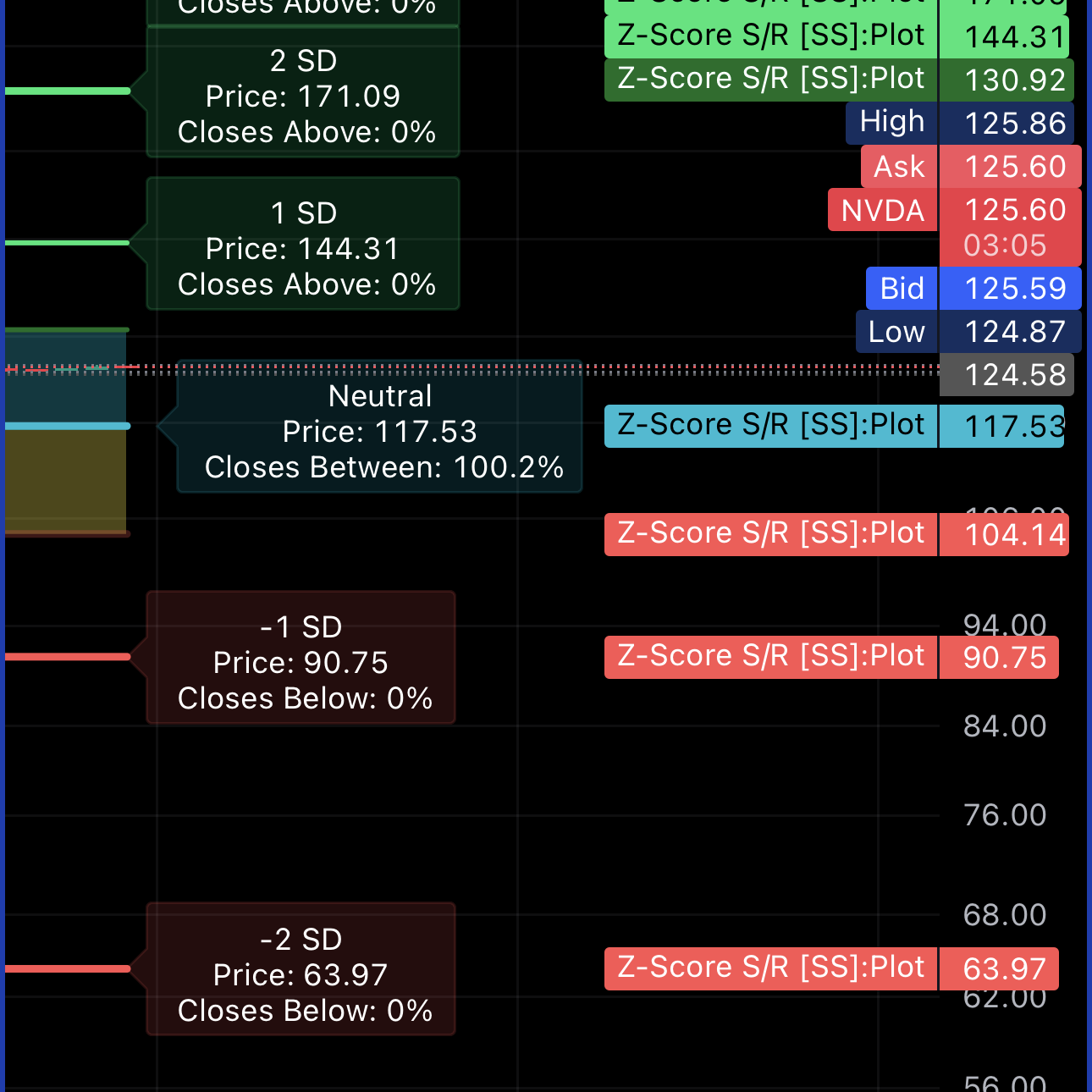

Thesis

2. Hedging with Call Optionsnn- Objective: Offset potential losses from puts by capitalizing on upward movement.n- Action:n1. Buy Call Options: Purchase out-of-the-money (OTM) calls (e. g. , $135 or $140 calls expiring this week).

Go back

Thesis

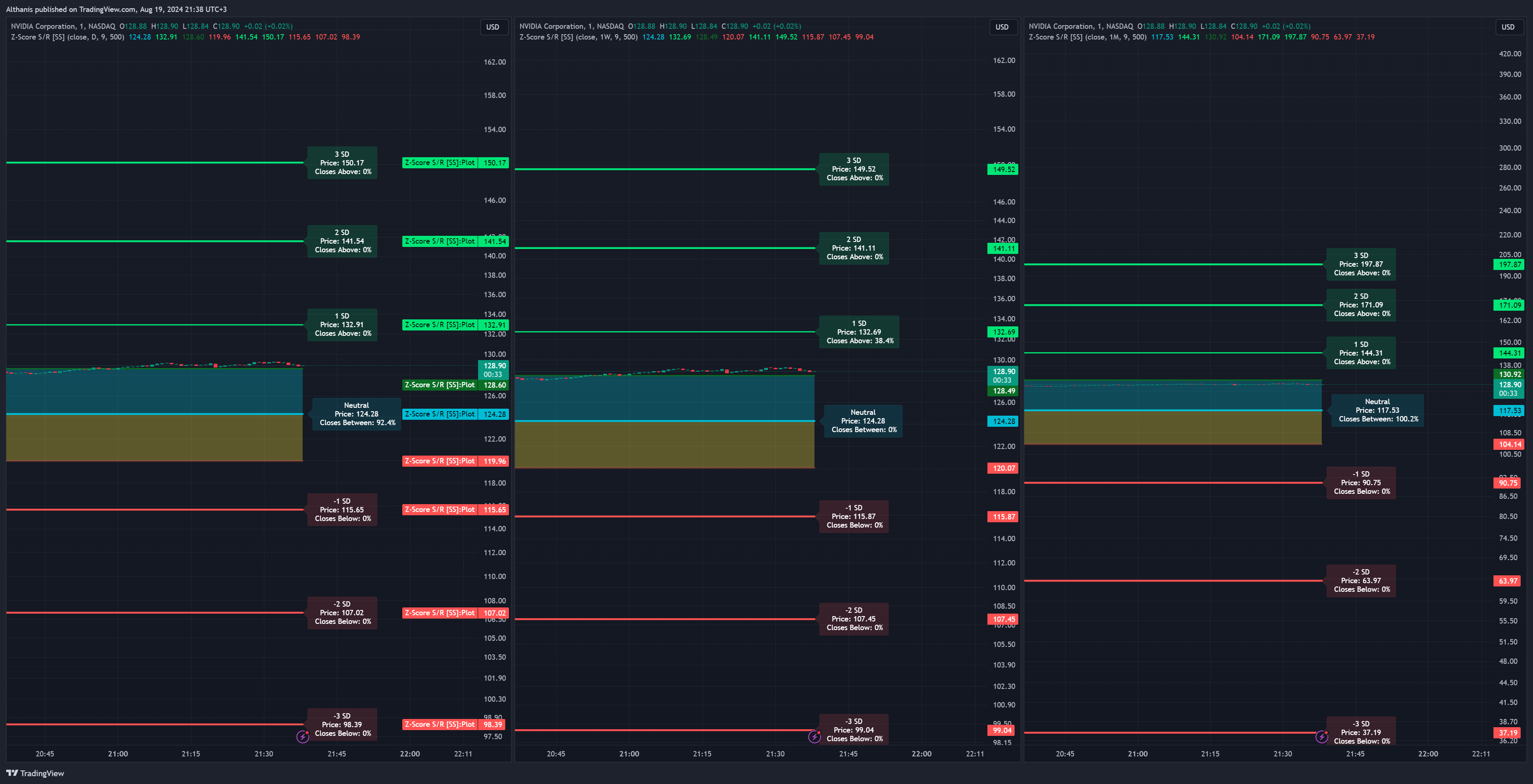

Conclusionnn- Higher Chances: NVDA has a moderate probability of moving above $132.69 by the end of the week but is more likely to stay within the monthly range of $130.92n- $104.14.nnRecommendation: Hold or Wait for a clearer signal. If you are looking for a short-term scalp, consider the potential for a move above $132.69, but be cautious of the broader monthly range.nnDisclaimer: Trading involves significant risk and is not suitable for all investors. Always conduct your own research and consider consulting with a financial advisor.

Go back

Posted

1.3y ago

-96.18%

Swung

•

Bullish

Saif

@althanis...

SYMB

Locked Data

some %

entered at Buy it

This

is a test thesis that is a placeholder for paid trades. Once you unlock this trade, you will

see

the actual thesis. Thank you, dont try to cheat!

Thesis

Bullish Sentiment: Higher IV for 130 calls suggests that the market expects significant upward movement.

Go back